Bankruptcies on the rise: impact of the reform of debt collection and bankruptcy law since 1 January 2025

Reform in force, companies in danger

On 1 January 2025, Switzerland embarked on a radical transformation of its debt collection system with the repeal of paragraphs 1 and 1bis of article 43 of the Federal Law on Debt Collection and Bankruptcy (LP). This legal amendment marks a profound change: from now on, debts under public law (VAT, taxes, social security contributions) can lead directly to the bankruptcy of a company entered in the commercial register, instead of being pursued through seizure as was previously the case.

An increase in bankruptcies: observations from January to June 2025

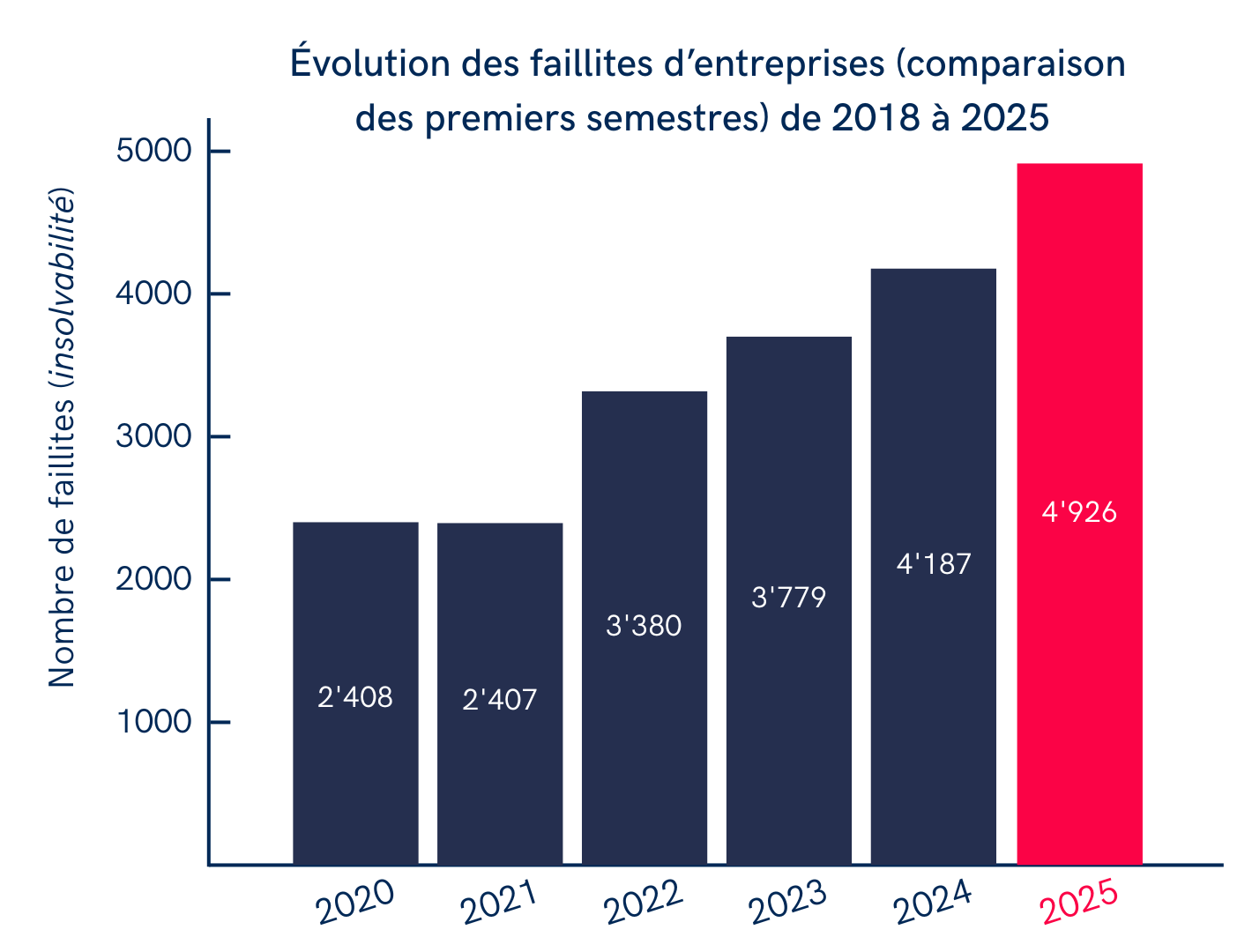

The impact of this reform is already being felt. According to the statistics in Creditreform's press release of 3 July 2025, business bankruptcies rose by almost 50% in June 2025, with more than 400 additional businesses going bankrupt compared with the previous year (June 2024).

Creditreform now anticipates almost 10,000 bankruptcies for the whole of 2025, not counting write-offs for default, which could bring the total to 13,000 businesses that have disappeared.

(Source: Creditreform, press release dated 3 July 2025)

Who is affected by the LP reform?

The reform, which came into force on 1 January 2025, applies to all entities entered in the commercial register, regardless of size or sector. This includes in particular :

- Public limited companies (SA)

- Limited liability companies (Sàrl)

- Registered sole proprietorships

- Associations entered in the commercial register

- The foundations

- Cooperatives

On the other hand, individuals not entered in the commercial register and unregistered associations are not affected by this measure and will continue to be subject to seizure proceedings as before.

This reform therefore directly affects any company or legal structure that carries out an officially registered economic activity, even the self-employed as long as they are registered. The aim is clear: to make commercial entities more accountable and to combat abusive behaviour.

The main causes: the LP reform and its consequences

This wave of bankruptcies is directly linked to the tougher legislation. By placing tax and social security authorities on an equal footing with private creditors, the law aims to eradicate abusive bankruptcies and make managers more accountable. Until now, companies could delay payment of their tax debts without immediate risk. Now, a single unpaid public debt can lead to bankruptcy, often without a prior hearing in some cantons (such as Geneva).

Managers face new responsibilities

All managers of companies, associations, foundations and self-employed people registered in the commercial register must now incorporate this reform into their day-to-day management. The new legislation entails not only a heightened duty of financial vigilance, but also a personal legal risk.

Checklist: are you ready for the LP reform?

Here are the 5 key actions to implement immediately:

- Settle all public arrears before legal action is taken.

- Negotiate payment schedules with the relevant authorities.

- Schedule an audit of your company's solvency.

- Updating governance and training governing bodies.

- Prepare a crisis management plan and, if necessary, apply for a debt-restructuring moratorium (LP).

Why was this change necessary?

The previous system encouraged a form of unfair competition, with some companies voluntarily delaying their public payments without consequences. The reform aims to protect private creditors and restore fairness to the economic fabric.

Act now to avoid the worst

The reform of the LP is now fully in force, and its effects are being felt most acutely. The figures are clear: the number of bankruptcies is soaring, and companies listed in the commercial register are on the front line. Faced with this new situation, inaction is no longer an option.

In this demanding context, Berney Associés is committed to working alongside you to help you get through this transition period safely. We offer tailor-made support for :

- Carrying out a situation audit

- Implement remediation and phasing plans

- Preparing and managing applications for debt-restructuring moratoria

- Train your managers in their new legal responsibilities

Our mission: to protect your company from the radical effects of this reform.

Company directors, the self-employed, managers - it's essential to comply today. Contact us for tailored support.

Latest news

Nouveautés RH pour 2026

L’année 2026 marque plusieurs évolutions majeures en droit du travail, assurances sociales et fiscalité, avec des impacts concrets pour les employeurs et les salariés. Nous faisons le point sur les changements au niveau national ainsi que sur les mesures spécifiques au canton de Genève.

Popular vote on November 30, 2025: initiative for the future

On November 30, 2025, Swiss voters will be asked to vote on an initiative to introduce a federal tax of 50% on inheritances and gifts exceeding CHF 50 million. Designed to finance the ecological transition, this measure raises practical questions for families who own SMEs, entrepreneurs, and holders of significant wealth.

Reform of the taxation of home ownership

Swiss property tax reform: abolition of rental value, new deduction rules, tax on second homes. Find out what our tax experts have to say.