HR news for 2025

Introduction

The year 2025 will bring a number of changes to human resources and social legislation in Switzerland. From the increase in the minimum wage in Geneva to the new AVS contributions and benefits, not forgetting the reform of the occupational pension scheme (LPP), here's an overview of the main developments to look out for.

BVG reform: New thresholds and amounts for 2025

The occupational pension scheme (BVG) will undergo some adjustments in 2025, with the revaluation of several contribution limits. Here are the new limits applicable from 1st January 2025 :

These changes will have an impact on the calculation of social security contributions and second-pillar cover for employees.

Minimum wage in Geneva: Increase in 2025

From 2025, the minimum wage in Geneva will rise to CHF 24.48 per hour. This represents the following amounts based on working hours :

This increase is intended to offset inflation and guarantee decent purchasing power for Geneva's workers.

Increase in AHV and IV pensions in 2025

From January 2025, pensions under the first pillar (AVS/AI) will be increased by 2.9 %, This represents a significant increase for pensioners and disability pensioners. The new values will be as follows:

- Minimum AVS pension: CHF 1,260 per month (instead of CHF 1,225.-)

- Maximum AVS pension: CHF 2,520 per month (compared with CHF 2,450)

- AVS pension for married couples: CHF 3,780.00 per month

This is the first adaptation since 2023, This will enable benefits to be adjusted in line with changes in salaries and the cost of living.

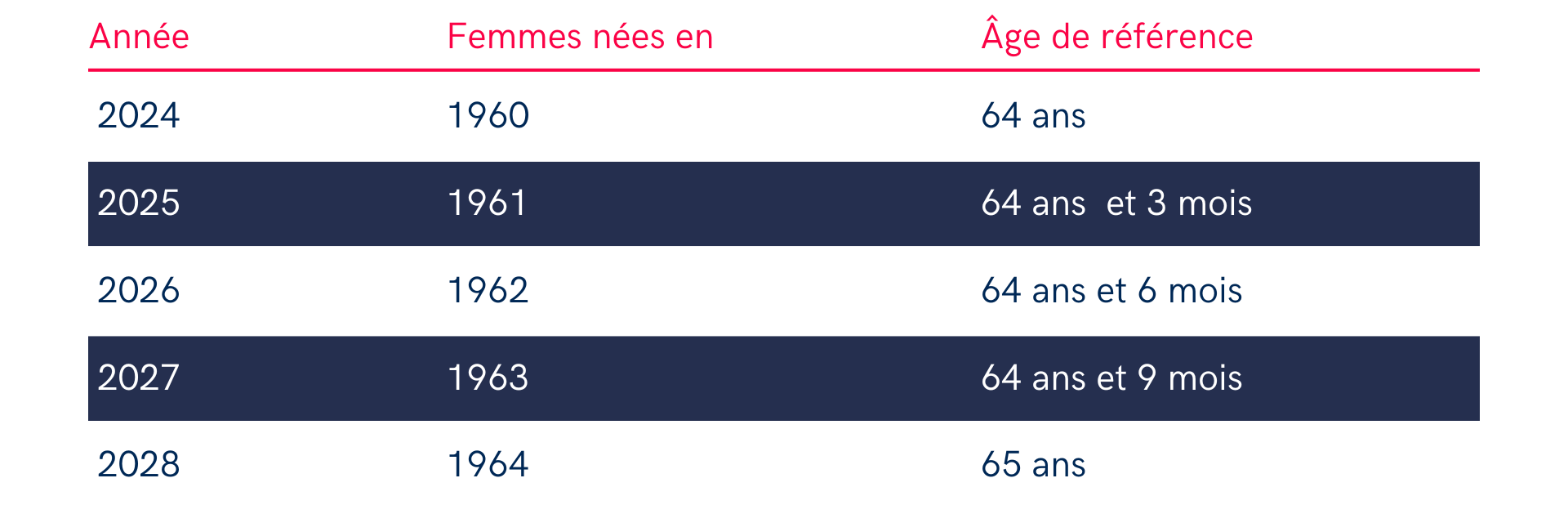

Women's pensions: gradual increase in the reference age

As part of the reform AVS 21, the reference retirement age for women will gradually increase to 65 years old from here 2028. Here is the transition timetable :

This change aims to harmonise the retirement age for men and women.

Family allowances: Increase in minimum amounts

From 2025, family allowances paid in certain cantons will increase:

- Child allowance : CHF 215.00 per month (compared with CHF 200.-)

- Training allowance: CHF 268.00 per month (compared with CHF 250.-)

This amendment mainly concerns the cantons that apply the minimum amounts set by the Confederation, in particular Aargau, Basel-Landschaft, Glarus, Solothurn, Ticino, Thurgau and Zurich. The other cantons are not obliged to adjust their amounts, but some may decide to align their benefits.

Employer contributions for family allowances: New contribution

From 2025, the employer's contribution to family allowances will increase to 2.25 %, This will have an impact on the cost of labour for businesses.

Minimum salary threshold raised to CHF 2,500

Le small salary - threshold below which no AVS contributions are due - will rise from CHF 2,300 to CHF 2,500 in 2025. This development facilitates the employment of temporary or occasional workers by reducing administrative burdens.

Minimum AVS/AI/APG contribution for the self-employed and persons not in gainful employment

The minimum AVS/AI/APG contribution for the self-employed and persons not in gainful employment will be increased to CHF 530 per year in 2025. This amount covers access to social benefits for these categories of workers.

Conclusion

These developments in occupational benefits, social security contributions and working conditions will have a direct impact on employers and employees in Switzerland. It is essential for companies to anticipate these changes to ensure optimum management of human resources and payroll in 2025.

Latest news

TVA Suisse : échéance du 28 février 2026 à ne pas manquer

Plusieurs changements TVA doivent être annoncés à l’AFC dans un délai de 60 jours après le début de l’année fiscale. Passé ce délai, leurs effets sont reportés à l’année suivante.

Véronique Pipoz devient COO du Groupe

La nomination de Véronique Pipoz au poste de Chief Operating Officer (COO) marque une nouvelle étape dans le développement du Groupe.

Nouveautés RH pour 2026

L’année 2026 marque plusieurs évolutions majeures en droit du travail, assurances sociales et fiscalité, avec des impacts concrets pour les employeurs et les salariés. Nous faisons le point sur les changements au niveau national ainsi que sur les mesures spécifiques au canton de Genève.