Initiative 179 - Cantonal vote of 12 March 2023

Popular initiative «Against the virus of inequality... Let's resist! Abolish tax privileges for large shareholders» (IN 179).

[Updated on 14.03.2023]

The people of Geneva voted intelligently, rejecting by almost 60% the 179 initiative aimed at taxing dividends up to 100%.

Despite this, the canton of Geneva remains at the top of the podium in terms of income and wealth tax. Let's hope that the people of Geneva will confirm their desire to keep entrepreneurs and wealthy taxpayers in their canton by also voting no to initiative 185, which aims to increase the maximum rate of wealth tax to 1.5% for 10 years.

This sharp increase, which some people are calling for, will drive many taxpayers out of Geneva, and so the aim of the initiative will not be achieved. On the contrary, new sources of revenue will have to be found or spending will have to be cut.

Introduction

Geneva is getting ready to vote on 12 March 2023. Initiative 179, «Hausse des impôts votation du 12 mars 2023», proposes a 100% tax on dividends paid to taxpayers who hold more than 10% of shares in a company of any size, including small and medium-sized enterprises.

The purpose of the initiative

Technically, the proposal is to amend article 19B and 22 paragraph 2 of the LIPP, in order to tax dividends from holdings belonging to the commercial or private assets of the individual taxpayer at 100%, even in the case of a qualifying holding (holding greater than or equal to 10%).

To simplify matters, today, if a shareholder holds at least 10% of shares in a company, he or she is taxed at 70% on the dividends received, if held in private assets (assets and rights not used for business purposes) and 60% if held in business assets (items used entirely or essentially for the exercise of a self-employed activity). Initiative 179 aims to abolish this tax reduction for shareholders at cantonal and municipal level. This means that shareholder taxation on dividends would amount to 100%.

As with any initiative, there are arguments in favour, from the initiators, and arguments against, from the opponents. In this article, our experts take a look at the various arguments to consider every aspect of the vote and their impact on our economy.

For or against the initiative?

Restoring «tax justice»

Supporters of the initiative believe that this would restore tax fairness, while opponents argue that it would jeopardise the region's SMEs and the jobs they create. This double taxation would punish entrepreneurs and slow down the region's economic growth.

The proponents of the initiative want to put an end to the inequality between salaries and pensions, which are taxed at 100%, and dividends from qualifying holdings, which are only partially taxed. According to the initiators, dividends do not contribute to social security contributions. In addition, they believe that this initiative will help to increase revenue for public authorities (around CHF 150 million estimated by the initiators).

SME owners hardest hit

The current situation is not intended to benefit people with shareholdings, but rather to reduce economic double taxation. Firstly, the company is taxed on its profits, and then its owner is taxed on the dividends (taxed by the company and then by the shareholder).

We often think of entrepreneurs as wealthy people running multinational corporations with profits of several million Swiss francs. However, the taxpayers targeted by this initiative will essentially be small entrepreneurs running their own SMEs, which could be a bakery, a restaurant, a painting firm, an architectural practice, a communications agency, an engineering company and many more. These entrepreneurs generally own most, if not all, of the shares in their company. It is these SMEs that benefit most from partial taxation. Investors, the large fortunes targeted by the initiators, diversify their financial portfolios and generally do not reach the 10% holding threshold.

Remaining an attractive canton

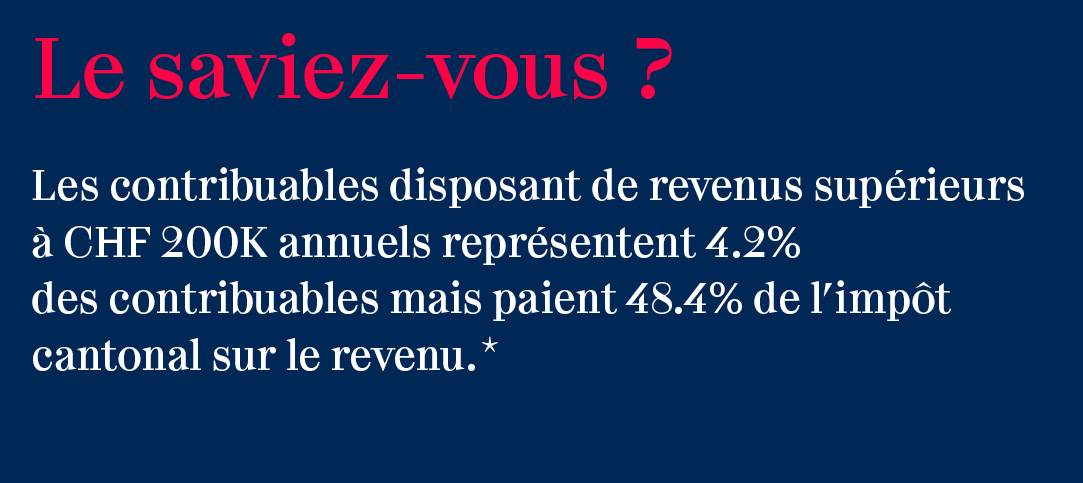

Swiss cantons are very competitive and it is important to remain an attractive canton: firstly, to keep taxpayers and secondly, to continue to create jobs. The canton of Geneva already taxes wealthy taxpayers the most.

Finally, the initiative risks damaging public finances.

*Situation at end March 2021

The impact of the initiative, if approved

These companies and SMEs contribute to the creation of more than 230,000 jobs in the canton. Such an initiative could encourage entrepreneurs to seek more favourable tax solutions in neighbouring cantons.

Indeed, if the initiative is approved, Geneva would become the only Swiss canton to tax dividends at 100%, while neighbouring cantons would apply lower tax rates, ranging from 60 to 70%. This could encourage entrepreneurs to move and indirectly drive them to relocate their businesses and activities to neighbouring cantons, which would have a negative impact on the region's economy.

In the shoes of an entrepreneur

Let's assume that Mrs Martin is the owner of an SME, a communications agency, in Geneva. It employs around thirty people. Mrs Martin's company will be taxed on its profits.

Mrs Martin will be taxed on her income, as well as on her assets, which include her company shares. The company will therefore have to pay tax on its profits. When the profit is paid to Mrs Martin in the form of a dividend, she will have to pay income tax on this return.

In order to mitigate this double taxation, an abatement of the tax base is currently provided: the dividend is therefore taxed at 31.5%, i.e. (33.5 +11.5)*70% (maximum rate taking into account the abatement) instead of 45% (maximum rate). If the initiative is accepted, Mrs Martin will no longer be able to benefit from the taxable dividend allowance at cantonal and municipal level.

The tax rate on the dividend would thus rise to 41.55%, i.e. (11.5 * 70% + 33.5%). This initiative will be highly detrimental to Geneva's entrepreneurial ecosystem, which could see a massive exodus of the canton's vital forces.

Why should I vote no?

In summary, initiative 179 is a controversial tax proposal that divides opinion in Geneva. While some believe it would restore tax fairness, there are concerns that it would seriously harm local entrepreneurs and hinder economic growth in the region. It remains to be seen what the outcome of the vote on 12 March 2023 will be, and how it will affect the region's economic future.

Latest news

35 ans d’histoire : un anniversaire célébré au cœur de la Laponie

Pour célébrer nos 35 ans, nous avons

emmené 140 collaborateurs en Laponie pour un séjour hors du temps, riche en expériences humaines et en souvenirs inoubliables.

TVA Suisse : échéance du 28 février 2026 à ne pas manquer

Plusieurs changements TVA doivent être annoncés à l’AFC dans un délai de 60 jours après le début de l’année fiscale. Passé ce délai, leurs effets sont reportés à l’année suivante.

Véronique Pipoz devient COO du Groupe

La nomination de Véronique Pipoz au poste de Chief Operating Officer (COO) marque une nouvelle étape dans le développement du Groupe.

Berney Associés takes a position on this vote and recommends that you vote «no».

Our experts will be happy to answer any questions you may have.