Revised Company Law 2023

On 1 January 2023, the revised law on public limited companies came into force, with the aim of relaxing certain rules, improving governance and clarifying certain points that were sources of legal uncertainty..

1. Greater flexibility in capital structure

1.1 Share capital in foreign currencies

Existing and new companies may now set their share capital in a foreign currency that is the most important in terms of the company's activities. In this case :

- The applicable exchange rate must be stated in the memorandum of association.

- The equivalent in CHF must be at least CHF 100,000.

1.2 Minimum nominal value

A share may now have a par value of less than 1 cent, provided it is greater than 0.

1.3 Capital fluctuation margin

The Articles of Association may authorise the Board of Directors to increase or reduce the share capital for a period not exceeding 5 years within the following limits:

- Lower limit: half the share capital entered in the Commercial Register (but not less than CHF 100,000)

- Upper limit: 1.5x the share capital entered in the Commercial Register

1.4 Capital reduction

Only one publication (instead of 3) of the notice to creditors in the Swiss Official Gazette of Commerce (SOGC) is now required, and creditors will only have 30 days (previously 2 months) to demand security for their claims following publication in the SOGC.

2. More flexible dividend payments

The Annual General Meeting may now decide, on the basis of interim accounts, to pay dividends from the profits of the current financial year (a practice prohibited until now).

The Statutory Auditors must audit the interim financial statements before the General Meeting (except in the case of opting-out) unless:

- All shareholders approve payment of interim dividends

- Creditors' claims are not compromised

3. Modernising General Meetings

3.1 Physical General Meeting

General Meetings may be held simultaneously at several locations. It is permitted to participate and vote remotely, by electronic means (telephone, videoconference or other). Speeches must be broadcast live by audiovisual means at all meeting venues.

3.2. Virtual General Meeting

Following the various restrictions linked to the Coronavirus, the revised law on public limited companies allows General Meetings to be held in virtual form if the Articles of Association so provide and if the Board of Directors designates an independent representative in the notice of meeting.

3.3 Universal Meeting

It is now possible to replace the formal General Meeting by decisions taken by circulation if all the shareholders participate and none of them requests a discussion.

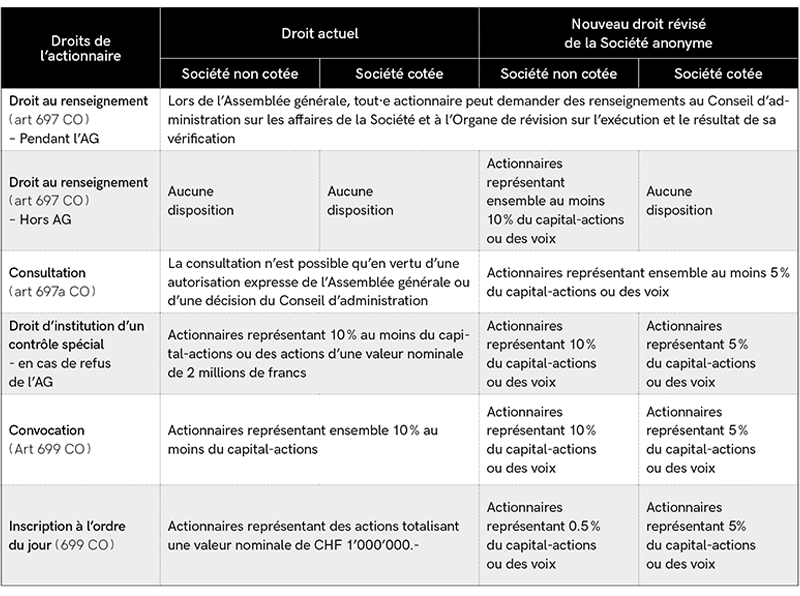

Strengthening shareholders' rights

The revised law on public limited companies introduces a lowering of the thresholds linked to shareholders' rights, as summarised below:

5. New obligations for companies in financial difficulty

The Board of Directors is required to monitor liquidity levels. If there is a threat of insolvency, it must take measures to ensure solvency.

If the company has no auditors, in the event of a loss of capital or overindebtedness, the latest annual accounts must be subject to a limited audit by an approved auditor before they can be approved by the General Meeting. The Board of Directors appoints the approved auditor.

See our full news item on this subject.

6. Rules specific to listed companies

6.1. Gender representation

The new law introduces quotas for gender representation in large listed companies. The representation of each gender will have to reach at least :

- 30 % on the Board of Directors

- 20 % in the General Management

If this is not the case, the remuneration report must mention:

- Reasons why the representation of each gender does not reach the minimum required

- Measures to promote the less-represented sex

6.2. Unfair remuneration

The Ordinance against abusive remuneration in listed public limited companies (ORab) has been repealed and the old rules, with a few modifications, have been included in public limited company law.

- Greater transparency for companies active in raw materials

Large companies involved in the production of raw materials must report all payments of at least CHF 100,000 to governments.

Companies have 2 years from 1 January 2023 to amend their Articles of Association, which must be recorded in a notarial deed and entered in the Commercial Register.

Latest news

Protected: CFO externalisé : un levier clé pour piloter et accélérer la croissance de votre entreprise

There is no excerpt because this is a protected post.

Imposition individuelle – Une réforme juste et équilibrée ?

L’imposition individuelle vise à mettre fin à une inégalité fiscale entre couples mariés et non mariés. Mais quels seront les effets concrets pour les contribuables lors de la votation du 8 mars 2026 ?

Market multiples at a glance

Dans un contexte marqué par les tensions commerciales, la force du franc suisse et une pression accrue sur les valorisations, le marché M&A en Suisse et en Europe a évolué vers davantage de sélectivité en 2025. Découvrez notre analyse des multiples EV/EBITDA, des dynamiques sectorielles et des perspectives 2026.

Our experts will be happy to advise you on how to apply the new provisions of the revised law on limited liability companies.

Please do not hesitate to contact us for further information.