HR: Joint social contributions 2023

All persons in gainful employment are obliged to pay contributions from 1 January following their 17th birthday until the end of their gainful employment. People born in 2005 will start contributing in 2023.

People who have reached retirement age (64 for women and 65 for men) and who continue to be gainfully employed continue to pay social security contributions, except unemployment insurance, and benefit from a monthly excess of CHF 1,400 from the month following their birthday.

Salaries of less than CHF 2,300 per year per employer are not subject to AVS unless the insured expressly requests it. We would like to point out that income of minor importance is not applicable in a private household and that salaries must therefore be subject to AVS from the 1st franc.

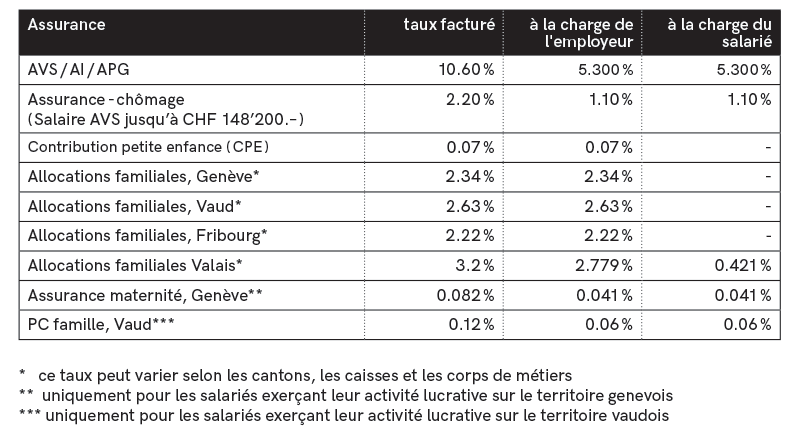

1. Statutory rates for calculating contributions on gross salaries

Note that the 1 % contribution for solidarity unemployment (AVS salary in excess of CHF 148,200) will no longer be levied from 1 January 2023.

The tax for vocational training will be levied in the form of a contribution on AVS wages. The rate will be between 0.03 % and 0.15 % depending on the wage bill.

2. Gainful employment in different countries

Please note that Swiss, European or EFTA nationals working simultaneously in Switzerland and in one or more countries (EU/EFTA) or registered as unemployed are subject to the social security system of only one country.

As each case is unique, we invite you to contact us for an analysis of your situation.

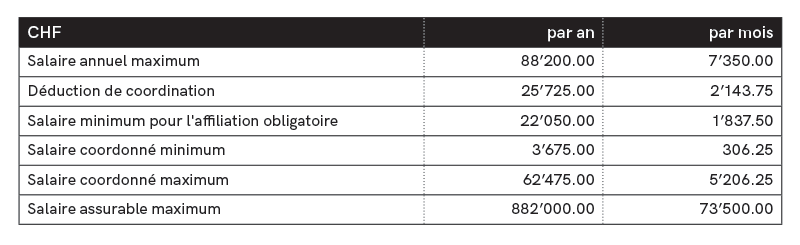

3. Occupational pensions (LPP - 2nd pillar / basic plan)

From 1 January following their 17th birthday, anyone who works for the same employer for more than 3 months and receives an annual salary of more than CHF 22,050 from that employer must be insured under the LPP. Under a basic occupational pension plan, employees are insured only for the risks of death and disability until 31 December of their 24th year.

The savings contribution for old age starts on 1 January of the year in which you turn 25. With effect from 1 January 2022, the limits for occupational benefits remain unchanged:

We would remind you that, since 1 January 2011, anyone who continues to work after retirement age can still contribute to occupational pension schemes up to and including the age of 69.

4. Tax source

All foreign residents (not holding a C permit, not married to a Swiss citizen or holding a C permit) are subject to withholding tax.

Withholding tax is deducted according to the tax scale of the employee's canton of residence. The employer must therefore register with the relevant canton and apply the rules of that canton.

All scale changes apply from the 1st day of the following month.

From 1 January 2023, all children up to the age of 25 can be taken into account in the applicable scale. However, if they are no longer apprentices or students, their income must be less than CHF 15,557 per year. The cost will be taken into account until the end of the month in which they turn 25.

5. Minimum wage 2023

The minimum wage applies to all employees working in the following sectors

in Geneva, with the exception of apprentices, trainees (as part of their school or vocational training) and minors.

The occasional professional activities of students aged over 18, known as «student jobs», are excluded from the scope of application of the minimum wage if the activity is covered by a collective labour agreement and if the following cumulative conditions are met:

- The student is registered with a training establishment

- The activity takes place during the training establishment's holiday period

- The activity does not exceed sixty continuous days per calendar year

- Salaries are set by the relevant joint committee

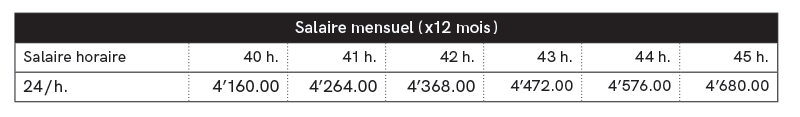

For 2023, the minimum wage in Geneva will be CHF 24.00 per hour:

6. APG (maternity, paternity and adoption benefit)

From 1 January 2023, the maximum salary insured under the federal loss-of-earnings insurance scheme will be increased. It will now be CHF 99,000. The basic allowance (80 % of the insured salary) will be a maximum of CHF 220 per day.

7. Adoption leave

From 1 January 2023, parents who adopt a child under the age of 4 will be entitled to two weeks' adoption leave (10 days), to be taken in one go or in the form of individual days within a year of welcoming the child. This leave will be compensated by loss-of-earnings allowances (APG).

The adoption loss-of-earnings allowance corresponds to 80 % of the subject salary, up to a maximum of CHF 220 per day.

In the event of a joint adoption and if the spouses meet the conditions laid down by law, the leave may be divided between the two parents. However, the parents may not take the leave on the same dates.

Latest news

Protected: CFO externalisé : un levier clé pour piloter et accélérer la croissance de votre entreprise

There is no excerpt because this is a protected post.

Imposition individuelle – Une réforme juste et équilibrée ?

L’imposition individuelle vise à mettre fin à une inégalité fiscale entre couples mariés et non mariés. Mais quels seront les effets concrets pour les contribuables lors de la votation du 8 mars 2026 ?

Market multiples at a glance

Dans un contexte marqué par les tensions commerciales, la force du franc suisse et une pression accrue sur les valorisations, le marché M&A en Suisse et en Europe a évolué vers davantage de sélectivité en 2025. Découvrez notre analyse des multiples EV/EBITDA, des dynamiques sectorielles et des perspectives 2026.

The Salaries department of Berney Associés will be happy to answer any questions you may have or provide you with any additional information.