What if I held my investment property through a property company?

Thanks to the fact that the taxation of company profits has become more attractive in recent years, the ownership of investment property by a property company can, in certain situations, be tax-efficient.

Introduction

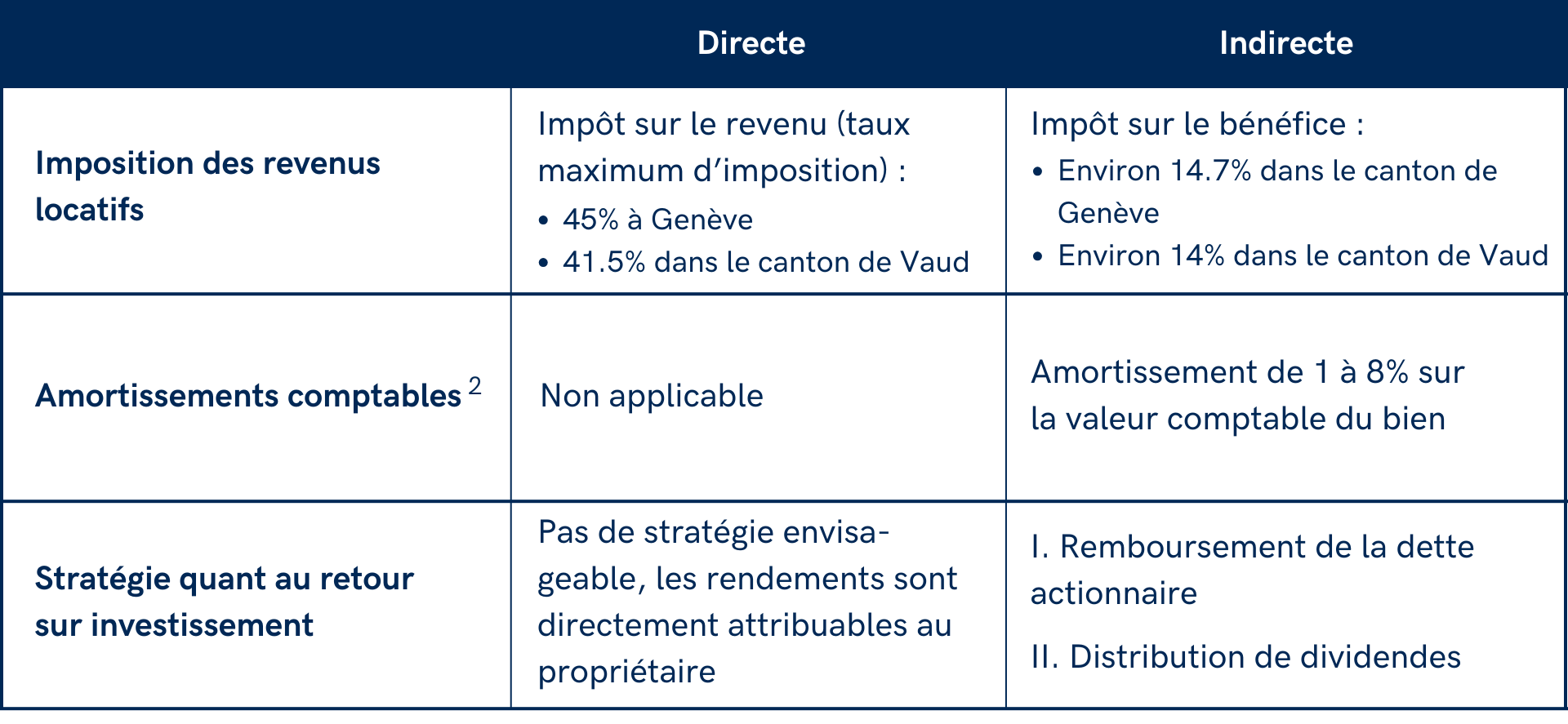

A landowner may own his property directly, or indirectly through a company, known as a «société immobilière». The two options have different tax implications:

- In the case of direct ownership, rental income is subject to income tax.

- If they are held indirectly via an SI, they are subject to income tax.

With the rate of tax on company profits having fallen in recent years, particularly in the cantons of Vaud and Geneva, property owners may be well advised to rethink the structure of their property holdings by opting to transfer their assets¹ to a company.

What is a «property company»?

A «real estate company» (often abbreviated «SI») is a company whose purpose is to own and manage real estate. It generally takes the form of a public limited company (SA) or a limited liability company (Sàrl).

From a tax point of view, an SI is taxed like an ordinary company, and its owners like traditional shareholders. The only difference is the tax treatment applicable to the sale of shares in an SI:

- When a taxpayer sells shares in an SI held in his private assets, the capital gain is generally treated as a property gain and therefore subject to property gains tax at cantonal level. Depending on the canton, transfer duties may also apply.

Transferring a property to an SI: what are the tax implications?

The transfer of an asset held in a taxpayer's private assets to an SI (generally in the form of a sale) systematically gives rise to two taxes:

1. Special tax on property gains

This tax is levied separately from the taxpayer's other income on the difference between the sale price to the SI and the acquisition value, at a degressive rate:

- In Geneva, this rate ranges from 50% for a holding period of less than 2 years to 2% after 25 years.

- In the canton of Vaud, the tax rate varies between 30% for a one-year holding period and 7% for a twenty-four-year holding period.

2. Transfer tax

Levied on the market value of the property, the approximate rate is 3.5%.

The transfer of a property to an SI gives rise to significant financial costs (property gains tax and transfer duties) that need to be taken into account at the time of the transaction.

On the other hand, the sale price can be recorded as a debt in the company's accounts and can be repaid on a tax-neutral basis using the company's profits.

Main differences between direct ownership and ownership by a property company

1. Repayment of shareholder debt

A shareholder debt may be recorded in the company's accounts, up to the amount of the sale price when the property is acquired by the SI. In the future, all repayments will be made on a tax-neutral basis, i.e. without tax for the shareholder.

2. Dividend distribution

Once the shareholder's debt has been repaid, the rents will generally flow back to the shareholder in the form of a dividend, which is taxable. The maximum tax rate on dividends is around 31.5% in Geneva and 29.05% in the canton of Vaud, provided that the shareholder holds at least 10% of the company's share capital.

Case study: sale of a Geneva property to a company

To illustrate the tax benefits of transferring a building to an SI, we have used the following assumptions:

- Married taxpayers taxed at the minimum rate

- Acquisition of the building in 1990 for CHF 6,000,000

- Tax valuation (Geneva) of the property of CHF 12,345,700 (tax value 5 years before the sale)

- Tax valuation of the property of CHF 8,00,000 (in force for more than 10 years)

- Net annual rental income (after charges) of CHF 400,000

- Sale of the building to an SI owned by the taxpayers in 2025 for CHF 12,500,000 (market value)

- Arrangement of a vendor loan (shareholder debt) of CHF 12,400,000

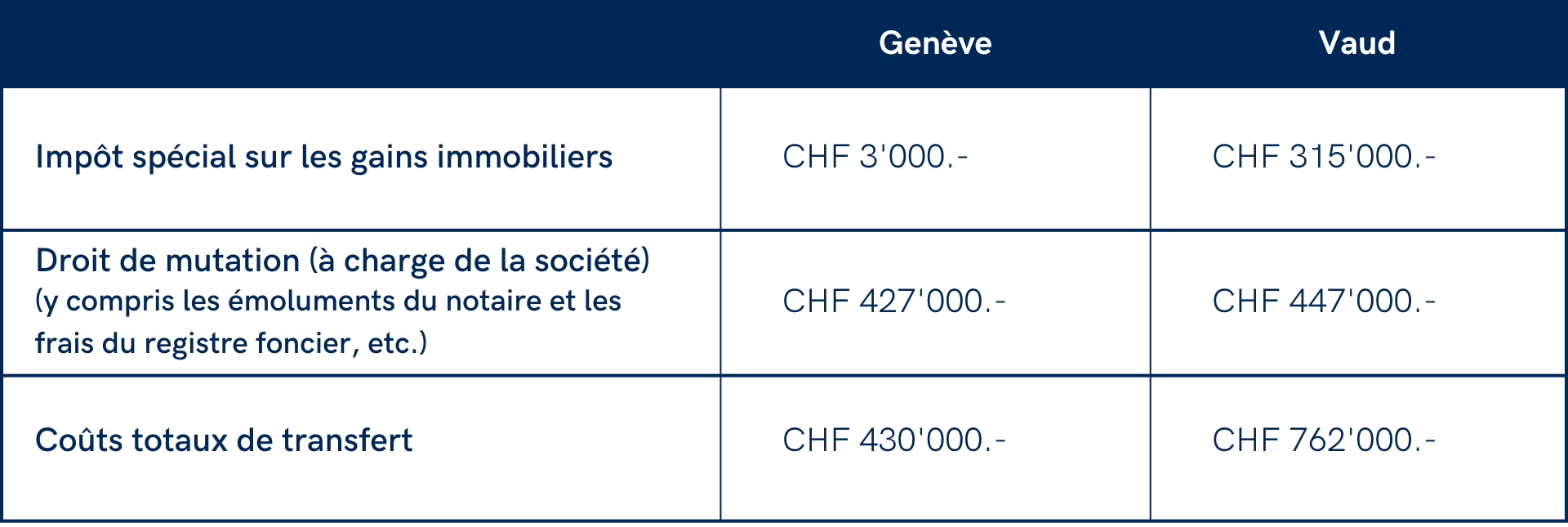

1. Transfer costs (in CHF)

The transfer of the building to the company gives rise to the following costs:

For Geneva:

The couple can invoke the tax estimate 5 years before the sale. Property gains tax is therefore levied on the difference between the sale value (CHF 12,500,000) and the tax valuation of the 2020 property (CHF 12,345,700) at a rate of 2%.

For Vaud :

The couple can invoke the tax valuation of the property, instead of the price paid, because it was notified after the acquisition of the property and had been in force for less than ten years at the time of the disposal. Property gains tax is therefore levied on the difference between the sale value (CHF 12,500,000) and the tax valuation of the property (CHF 8,000,000) at the rate of 7%.

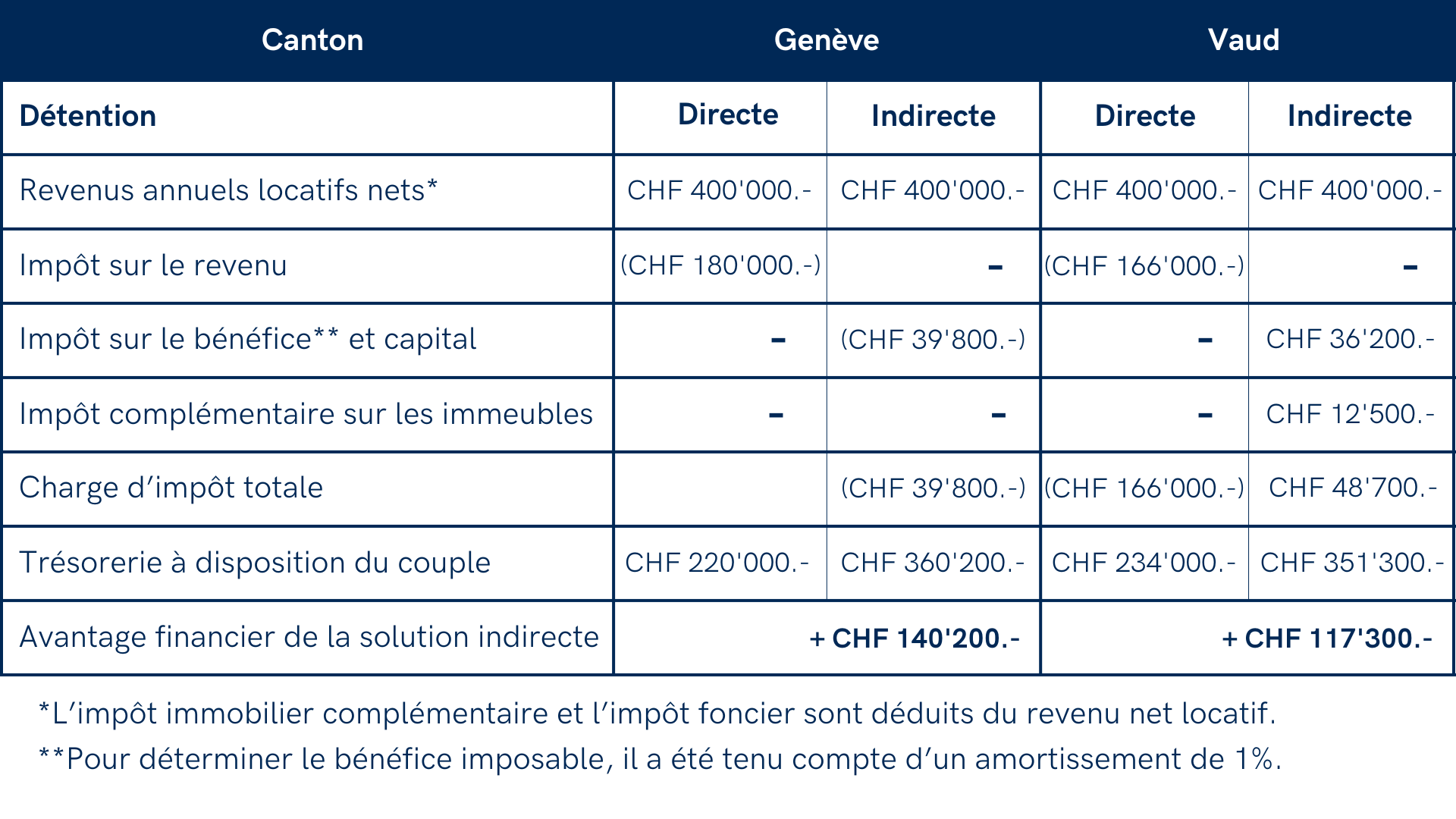

2. Tax on rental income (in CHF)

According to our estimates for the canton of Geneva, the transfer costs of CHF 430,000 (i.e. tax on property gains and transfer duties) are amortised in just three years thanks to the annual tax savings made during those years. In fact, over the long term, holding the property through an SI results in tax savings of more than CHF 140,000 per year. Finally, for around thirty-four years, the couple will be able to receive an annual tax-free payment of around CHF 360,000 from the repayment of their shareholder current account, whereas they would receive only CHF 220,000 if they held their shares directly.

In the Vaud case study, the transfer costs of CHF 762,000 (i.e. property gains tax and transfer duties) are amortised in around 7 years thanks to the annual tax savings achieved during those years. In fact, over the long term, holding the property through an SI results in tax savings of more than CHF 117,300 per year. Finally, for around thirty-five years, the couple will be able to receive an annual tax-free payment of around CHF 351,300 from the repayment of their shareholder current account, whereas they would receive only CHF 234,000 if they held the shares directly.

Conclusion

Although the sale of a property to an SI generates significant and unavoidable costs at the time of transfer, these can be recouped fairly quickly thanks to the tax savings generated by indirect ownership. In addition, holding property through an SI can be advantageous in the event of inheritance or gift, as it is easier to transfer shares than a proportion of the property.

In conclusion, we would remind you that it is nevertheless essential to study each situation and carry out tax simulations before proceeding with such an operation.

Notes :

1. We are talking here about investment property and not the family home, which, in our opinion, has no tax advantage in being held via a company, since the shareholder-tenant must then pay rent to his company for occupying the property.

2. It should be noted, however, that if the company subsequently sells the property, the accumulated depreciation will be subject to income tax.

Latest news

Véronique Pipoz devient COO du Groupe

La nomination de Véronique Pipoz au poste de Chief Operating Officer (COO) marque une nouvelle étape dans le développement du Groupe.

Nouveautés RH pour 2026

L’année 2026 marque plusieurs évolutions majeures en droit du travail, assurances sociales et fiscalité, avec des impacts concrets pour les employeurs et les salariés. Nous faisons le point sur les changements au niveau national ainsi que sur les mesures spécifiques au canton de Genève.

Popular vote on November 30, 2025: initiative for the future

On November 30, 2025, Swiss voters will be asked to vote on an initiative to introduce a federal tax of 50% on inheritances and gifts exceeding CHF 50 million. Designed to finance the ecological transition, this measure raises practical questions for families who own SMEs, entrepreneurs, and holders of significant wealth.