3rd Pillar A purchases from 2025: how does it work and what are the tax benefits?

Introduction

A key component of the old-age pension system, the 3rd pillar A (hereinafter «3a») is designed to supplement state (1st pillar) and occupational (2nd pillar) pension provision. When taxpayers contribute to the 3a scheme, they can deduct these contributions from their taxable income up to an annual ceiling. In 2025, this ceiling will be CHF 7,258 for employees (’small« 3a) and CHF 36,288 for self-employed persons not affiliated to a 2nd pillar pension scheme (»large’ 3a).

From 1 January 2025, you will be able to buy into your 3a savings. This represents an opportunity to maximise the tax benefits associated with this instrument for people who have not contributed in full.

This article attempts to answer the main questions raised by this new version of the ordinance governing 3a(1) tax deductions. We will use the term «reference year» to refer to the period bought back and «buy-back year» to refer to the year in which the buy-back payment is made.

The main questions raised by this reform

1. From what date do buy-backs become possible?

Purchases are possible from the entry into force of the new version of the ordinance, i.e. for the years 2025 and after. If the taxpayer has not made full contributions for a period prior to 2025, the purchase is not possible (see example). In practice, the first purchases will therefore be possible from 2026.

2. How much can I buy back?

It is possible to buy back one or more reference years if the maximum contribution for that year has not been reached. The amount of the purchase corresponds to the difference between the maximum eligible contribution for the reference year and the contribution actually paid (see example).

However, it is not possible to buy back a reference year over several buyback years (the buyback cannot be split).

For self-employed people who do not have a 2nd pillar, only an amount equivalent to the contributions authorised for an employee («small» 3a) can be bought back.

3. What is the deadline for making a buyback?

You can buy back up to ten years retroactively. As long as the ten-year anniversary of the entry into force has not been celebrated, it will only be possible to buy back from the year 2025.

4. What are the conditions for a buyback?

i.The taxpayer must have been entitled to contribute during the reference year. This entitlement is validated if the taxpayer received income subject to AVS during the reference year; ;

The taxpayer must have made full contributions during the year of the buy-back before buying back the reference year (see example).

5. What about the treatment of married people and those close to retirement?

Married couples and registered partners will be able to claim buy-ins for each of them, as is the case for ordinary payments.

It is still possible to buy back up to 5 years from the normal AVS/AHV retirement age, provided that the taxpayer is still in gainful employment and has not started receiving 3a retirement benefits.

6. How do I make a buyback?

Once the taxpayer has determined that he is entitled to make a purchase and wishes to do so, he must submit a written request (signed document) to the pension fund, providing the following information:

- The amount of redemption requested ;

- The year he wants to fill ;

- The amount actually paid during the reference year ;

- Proof of full payment during the buyback year.

Once these conditions have been met, the taxpayer will be authorised to make the purchase by the pension fund, which will provide proof so that the purchase can be deducted when the tax return is drawn up.

Practical example

Julie is single and lives in Lausanne. Her net income (before deduction of 3a) is CHF 150,000.

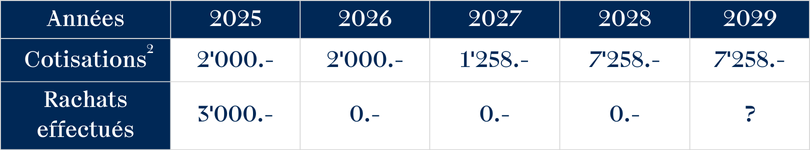

To optimise her tax position, her advisor recommended that she contribute to her 3a. However, Julie preferred to save for an electric car. For the years 2025 to 2027, she therefore did not make the maximum authorised contribution to her 3a. Julie's 3a contributions can be summarised as follows:

Julie would like to make a 3rd pillar A purchase in 2029. What is the highest possible purchase amount? What tax savings will she make with this purchase?

Firstly, to be able to make a buy-back in 2029, Julie must have contributed the maximum amount during the buy-back year. In this case, she meets this condition by having contributed the necessary CHF 7,258.

In theory, Julie can buy back up to 10 years before the buy-back year, i.e. up to 2019. However, it is not possible to buy back before the Ordinance comes into force, i.e. 2025. She will therefore not be able to buy back any years before 2025.

Julie's total redemption amount in 2029 can be summarised as follows:

a. 2025 0.- because the partial purchase of CHF 3,000 already made means that he is no longer entitled to a supplementary purchase; ;

b. 2026 : 5’258.- (7’258-2’000) ;

c. 2027 : 6’000.- (7’258-1’258) ;

d. 2028 0, because the maximum contribution has already been reached.

Julie may apply to buy back the years 2026 and 2027 for a maximum total amount of CHF 11,258 (CHF 5,258 + CHF 6,000). She may also request a smaller buy-in (e.g. only the 5,258.- for 2026).

In her application, she will have to prove that she has made full contributions during 2029 and state explicitly which year she wishes to buy back.

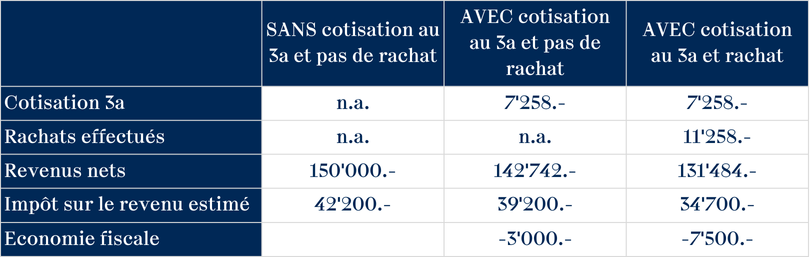

By way of comparison, 3a contributions and related purchases could generate the following tax savings in 2029 :

By making the maximum authorised contribution to her 3a savings plan, Julie saves CHF 3,000 in tax. If she makes an additional payment in 2029 (buy-in), her tax bill will be CHF 7,500 lower than it would have been without the 3a contribution and buy-in.

Conclusion

We can summarise the key points relating to the buyback in 3a as follows:

- It is only possible to buy back a reference year when the full amount of the contribution for the buy-back year has been paid; ;

- If part of a reference year has been bought back, the balance can no longer be bought back; ;

- Redemptions can be made over the last 10 years from 2025. The first redemptions can therefore be made in 2026; ;

- To be entitled to buy back a reference year, the taxpayer must have received income subject to AVS during that period; ;

- Thanks to this new «tool», taxpayers can optimise and manage their taxation and savings more flexibly.

Sources :

- Ordinance of 13 November 1985 on tax deductions for contributions to recognised pension schemes (RS 831.461.3 / OPP 3), as at 1 January 2025.

- Assuming that the maximum deduction is CHF 7,258 for small 3a for the years 2026 to 2029.

Latest news

Protected: CFO externalisé : un levier clé pour piloter et accélérer la croissance de votre entreprise

There is no excerpt because this is a protected post.

Imposition individuelle – Une réforme juste et équilibrée ?

L’imposition individuelle vise à mettre fin à une inégalité fiscale entre couples mariés et non mariés. Mais quels seront les effets concrets pour les contribuables lors de la votation du 8 mars 2026 ?

Market multiples at a glance

Dans un contexte marqué par les tensions commerciales, la force du franc suisse et une pression accrue sur les valorisations, le marché M&A en Suisse et en Europe a évolué vers davantage de sélectivité en 2025. Découvrez notre analyse des multiples EV/EBITDA, des dynamiques sectorielles et des perspectives 2026.