Accounting for private expenses in your company: the risks associated with such practices

Introduction

When a company covers the costs of its shareholder's lifestyle, these two separate individuals risk serious consequences. This Taxnews will attempt, through a practical example, to set out the main consequences of such practices.

1. Case studies

A few years ago, Robert founded Juice SA, a company based in the canton of Geneva. This company is active in the production of fruit juices. Robert, who lives in Lausanne, is the sole shareholder of Juice SA. In 2023, the company achieved a net profit of CHF 20,000. During the year, it recorded the following expenses in particular:

a) Meal expenses of CHF 5,000 for Robert's partner Amélie's birthday dinner;

b) Cost of hiring a transport vehicle for CHF 15’000.-. This vehicle belongs personally to Robert. The normal value of this lease would be CHF 14,000;

c) Travel expenses of CHF 10,000.for a 10-day trip to Kuala Lumpur to visit a factory. During the trip, Robert plans to spend 2 days visiting his daughter Zoé, who is studying in Malaysia.

The company was taxed on the basis of the return filed, which was consistent with the accounts. The same applied to Robert. In 2024, the cantonal tax authorities carried out an audit of the company's books.

2. Theoretical elements

A. The concept of an appreciable cash benefit (hereinafter «ACB»)

According to the established case law of the Federal Court, a MAP exists when the following four conditions are met:

- the company provides a service without obtaining any corresponding consideration;

- this benefit is granted to a shareholder or a person in close contact with him or her ;

- it would not have been granted under such conditions to a third party;

- the disproportion between the benefit and the consideration is obvious, so that the company's organs could have realised the advantage they were granting.

In other words, when the company grants an unjustified benefit to its shareholder or a close relative, it is likely to make a MAP. In the event of such a transaction, the tax authorities may reinstate the expense (commercially unjustified benefit) in the company's profit and add an equivalent amount to the shareholder's income. Assuming that taxation has become effective, these corrections are made by means of tax reminder.

B. Elements of criminal tax law

Once the tax assessment has come into force, both the company and the shareholder may, in addition to the tax assessment, be held liable for subtraction consumed tax. The penalty for this offence is a fine. The fine is at least one third and no more than three times the amount of tax evaded.

In addition, as an organ of the company, the shareholder is also exposed to the criminal offence of use of forgeries, These include fraudulent misrepresentation (e.g. incorrect accounting).

Finally, Article 177 LIFD also provides for penalties for instigation, complicity or participation to the tax evasion by the company. In such cases, the shareholder is liable to a fine and may be held jointly and severally liable for the amount of the tax owed by the company.

3. Solving the case study

In this case, the question is whether the transactions meet the cumulative conditions for a MAP:

- In case a), the costs of Amélie's birthday meal clearly meet the conditions of the MAP. They are without consideration and granted solely because Robert is the shareholder of Juice SA. The amount considered as PAA is CHF 5,000.- ;

- In case b), the question of a consideration equivalent to the service arises. If the tax authorities consider that the rental price paid by Juice SA is too high, they may treat part of the transaction as a MAP. However, since the difference between the market rental price and the price charged is not significant, we consider that the price and the expense of CHF 15,000 will be accepted for tax purposes; ;

- In case c), the expenses for the business trip are, in principle, justified. On the other hand, the part of the expenses relating to Robert's visit to his daughter Zoé will be considered as MAP as they have no connection with Juice SA's activities. In this case, we will consider that the amount to be added back to profit is CHF 2,000.

Now that these operations have been reclassified, what are the consequences for the various players involved?

A. At Juice SA

Unjustified expenses will be added back to taxable profits via the tax reminder, In addition, interest will be charged on the amount due. In addition, late payment interest will be charged on the amount due. Finally, in addition to this reminder, Juice SA will have to pay a fine for the tax evasion.

As these expenses are reclassified as PAA, Juice SA must deduct withholding tax of 35% on this concealed distribution. This withholding tax must be paid by the shareholder.

B. With Robert

Since Robert did not declare the MAPs obtained (treated as concealed dividend distributions) in his 2023 tax return, the tax authority will carry out a tax reminder to recover the tax due. However, as he owns more than 10% of Juice SA, Robert will be able to benefit from partial taxation of his dividend. He will also have to pay default interest.

As Robert did not declare all his income, he will be prosecuted for tax evasion consumed. As an organ of Juice SA, he may also be prosecuted for use of forgeries since Juice SA's accounts are false.

Depending on his involvement, Robert could also be accused of complicity in the tax evasion committed by Juice SA. In this situation, he would be jointly and severally liable for payment of the tax owed by Juice SA.

Finally, there is the question of the possible reimbursement of the withholding tax charged to Robert by Juice SA.

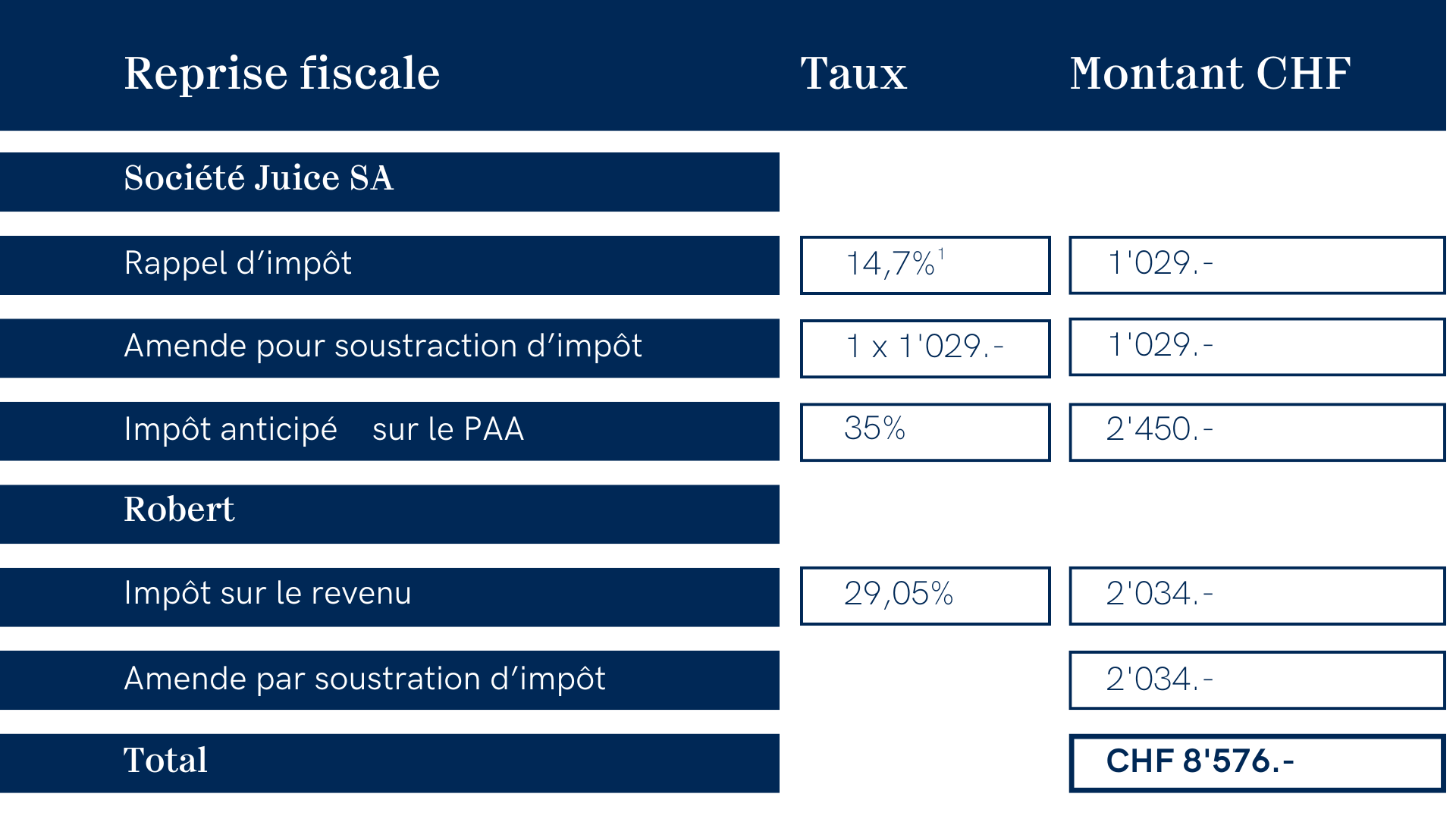

C. Summary table of consequences

As a reminder, the total amount of the PAA is CHF 7,000.

Please note that interest will be charged on any tax due.

4. Conclusion

It is crucial that companies, and their shareholders, take care to distinguish between the personal finances of shareholders and those of the company. The practical example described above illustrates that apparently innocent expenses can have serious tax and criminal consequences.

Generally speaking, the first thing that comes to mind is the economic impacts resulting from this. This is all the more justified in view of the fact that the total amount of the fines can exceed one third of the incorrectly booked costs (in the case in point, a total fine of more than CHF 3,000 for CHF 7,000 of incorrect bookings, not including default interest).

However, it is important not to underestimate the administrative impacts, particularly in relation to the justification of such expenditure. The time required to deal with tax audits and reminders, which can go back as far as ten years, can be very time-consuming. In our practice, we have noticed that it is often tedious to justify meal or entertainment expenses that date back several years.

To deal with these risks, it may be useful to use rulings to endorse certain transactions between the shareholder and the company in advance. In most cases, however, we also recommend implementing a policy for tracing and justifying expenditure. For example, it may be a good idea to indicate which customers are the beneficiaries of expenses on expense reports (restaurant vouchers, gift invoices, etc.).

Finally, it is also possible for the shareholder or the company to voluntarily report any infringements. Under certain strict conditions, this mechanism makes it possible to reduce or even waive the fine.

To avoid such situations, it is advisable to comply strictly with tax regulations. Our tax experts will be happy to answer any questions you may have on this subject.

Sources :

1. Berney Associés, Guide Fiscal, N82, available at the following address: https://berneyassocies.com/guide-fiscal-2024/ 14% VD; 14,11% FR; between 11,89% and 17,08% VS.

Latest news

35 ans d’histoire : un anniversaire célébré au cœur de la Laponie

Pour célébrer nos 35 ans, nous avons

emmené 140 collaborateurs en Laponie pour un séjour hors du temps, riche en expériences humaines et en souvenirs inoubliables.

TVA Suisse : échéance du 28 février 2026 à ne pas manquer

Plusieurs changements TVA doivent être annoncés à l’AFC dans un délai de 60 jours après le début de l’année fiscale. Passé ce délai, leurs effets sont reportés à l’année suivante.

Véronique Pipoz devient COO du Groupe

La nomination de Véronique Pipoz au poste de Chief Operating Officer (COO) marque une nouvelle étape dans le développement du Groupe.