Advantages of lump-sum taxation in Switzerland

From April this year, the UK is changing the rules on non-dom resident status to make it less advantageous. Portugal will implement similar changes to its non-habitual resident status from the end of April 2025.

At a time when these changes in international tax policy are taking shape, it seems appropriate to take stock of the Swiss legislation that is comparable to this type of status, i.e. taxation based on expenditure (also known as «lump-sum» taxation). This system allows foreign taxpayers to be taxed on a fixed basis - a lump sum - calculated according to the taxpayer's expenses.

Our team of specialists has expertise based on many years' experience in negotiating lump-sum packages. You can rely on our know-how to help you navigate this complex tax landscape.

Conditions

To qualify for l'imposition d'après la dépense, the taxpayer (or both spouses if they live in the same household) must meet the following cumulative conditions:

1. Do not have Swiss nationality ;

2. Be subject to unlimited taxation for the first time in Switzerland or after an absence of at least ten years; ;

3. Not be gainfully employed in and/or from Switzerland.

This tax regime is granted at the taxpayer's request and must be applied for prior to arrival in Switzerland or, at the latest, before the first tax assessment.

Calculating the tax base

The lump sum is the result of an agreement with the relevant cantonal tax authority. It corresponds to the highest of the following three values:

1. 7 x the rental value of the property acquired by the taxpayer (as determined by the relevant authorities) or 7 x the rent paid if the property is rented; ;

2. The taxpayer's annual worldwide lifestyle (including tax) ;

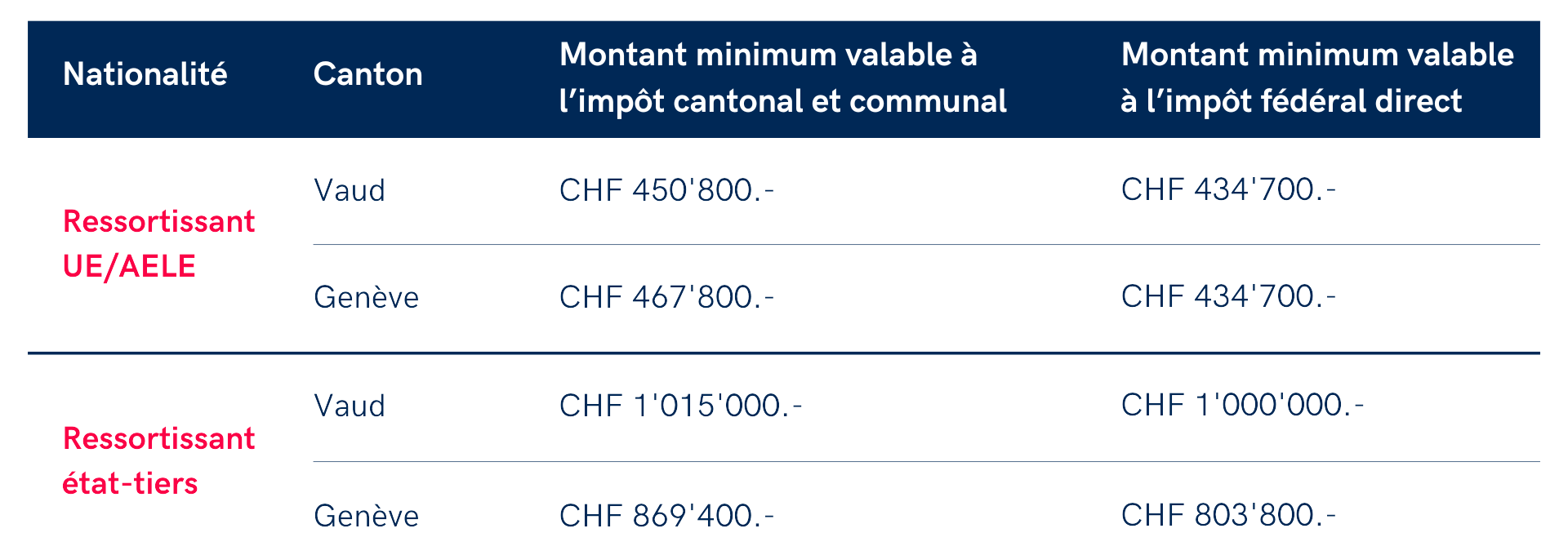

3. The minimum base set by law, i.e. at 1 January 2025 :

In addition, when the tax return is filed, the tax due on the basis of the lump sum is compared with the tax theoretically due on the taxpayer's Swiss income and assets («control calculation»). If the amount of tax resulting from the control calculation is higher than the amount of tax due on the lump-sum basis, the control calculation takes precedence.

The relationship with double taxation agreements

In principle, taxpayers subject to taxation based on expenditure may avail themselves of the advantages offered by double taxation agreements. However, certain treaties (Germany, Austria, Belgium, Italy, Norway, the United States and Canada) only apply if income from these countries is subject to tax in Switzerland.

Comparison between taxation on expenditure and ordinary taxation

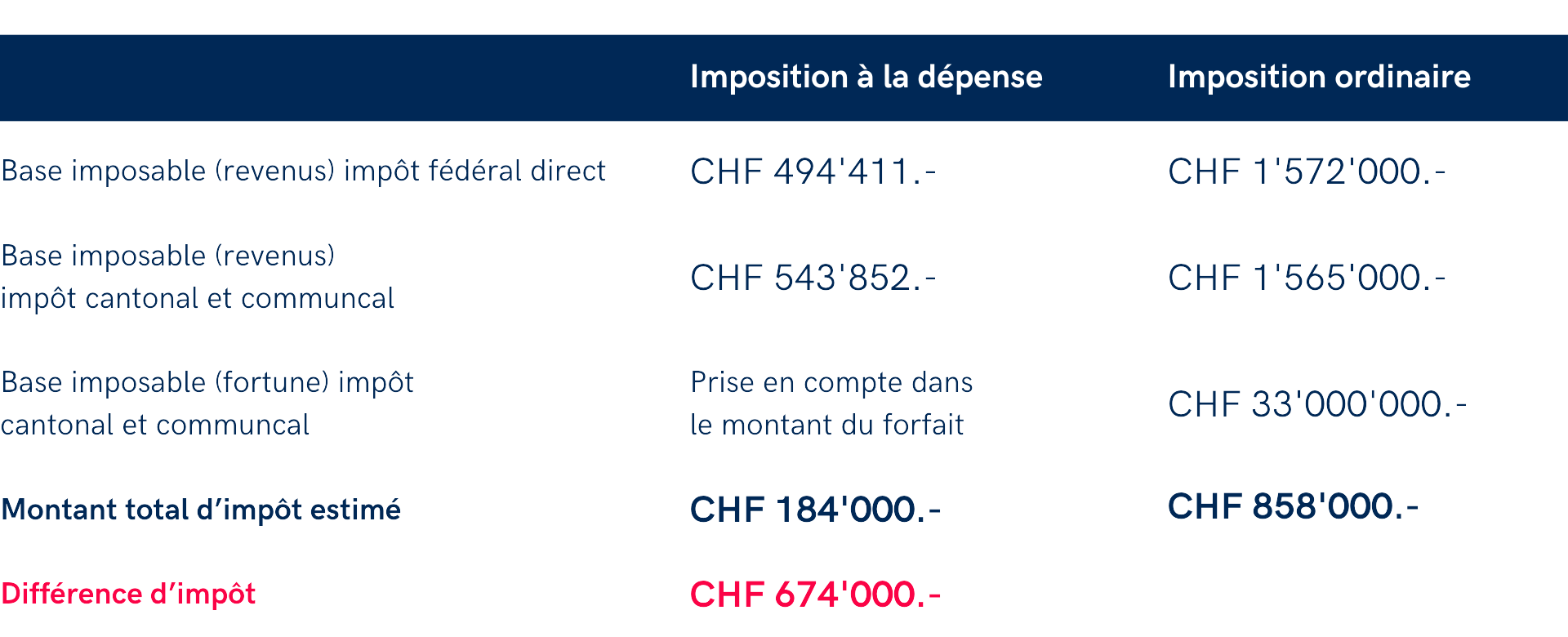

Mrs Wagner, an annuitant of German nationality, previously resident in the United Kingdom under the «non-dom» regime, decided to move to the canton of Geneva in 2025. Her assets, consisting of non-Swiss securities, totalled CHF 30 million, generating an annual return of CHF 1,500,000. She has acquired a house in Collonge-Bellerive, in which she lives, valued by the tax authorities at CHF 3 million, with a rental value of CHF 80,000. Her annual expenses (excluding tax) amount to CHF 350,000. The tax comparison is as follows:

Although some countries are drastically changing their tax policies, Switzerland continues to offer opportunities thanks to lump-sum taxation. This tax regime requires special procedures and monitoring, and our Tax Department, with its wealth of experience in negotiating these statuses, is at your disposal to answer any questions you may have and to support you every step of the way.

Latest news

Nouveautés RH pour 2026

L’année 2026 marque plusieurs évolutions majeures en droit du travail, assurances sociales et fiscalité, avec des impacts concrets pour les employeurs et les salariés. Nous faisons le point sur les changements au niveau national ainsi que sur les mesures spécifiques au canton de Genève.

Popular vote on November 30, 2025: initiative for the future

On November 30, 2025, Swiss voters will be asked to vote on an initiative to introduce a federal tax of 50% on inheritances and gifts exceeding CHF 50 million. Designed to finance the ecological transition, this measure raises practical questions for families who own SMEs, entrepreneurs, and holders of significant wealth.

Reform of the taxation of home ownership

Swiss property tax reform: abolition of rental value, new deduction rules, tax on second homes. Find out what our tax experts have to say.