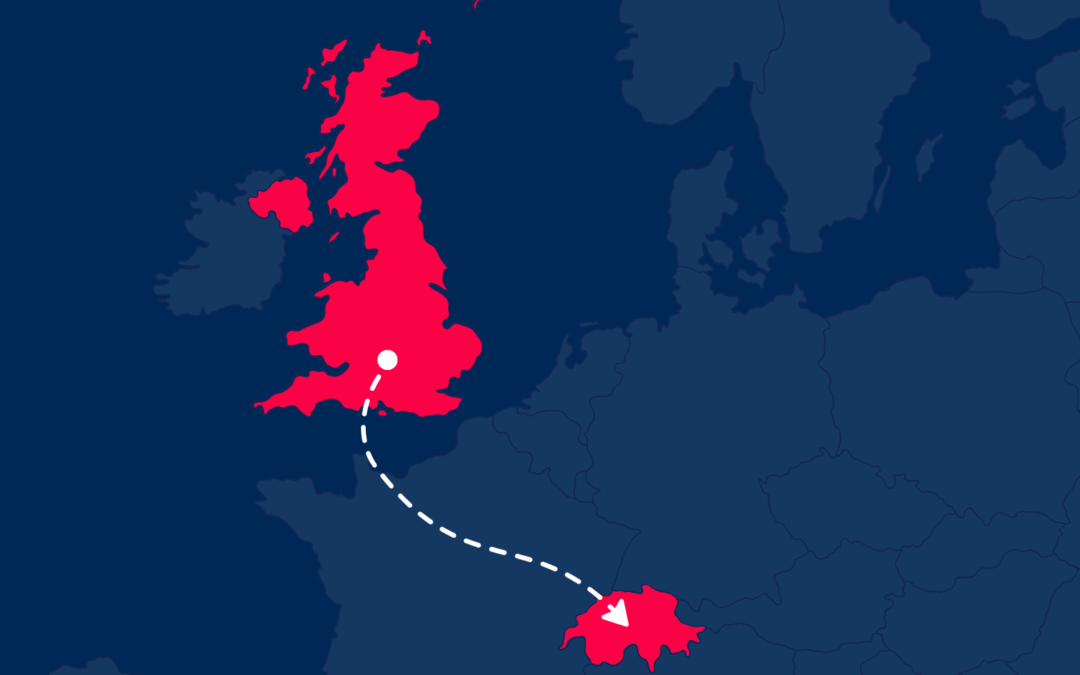

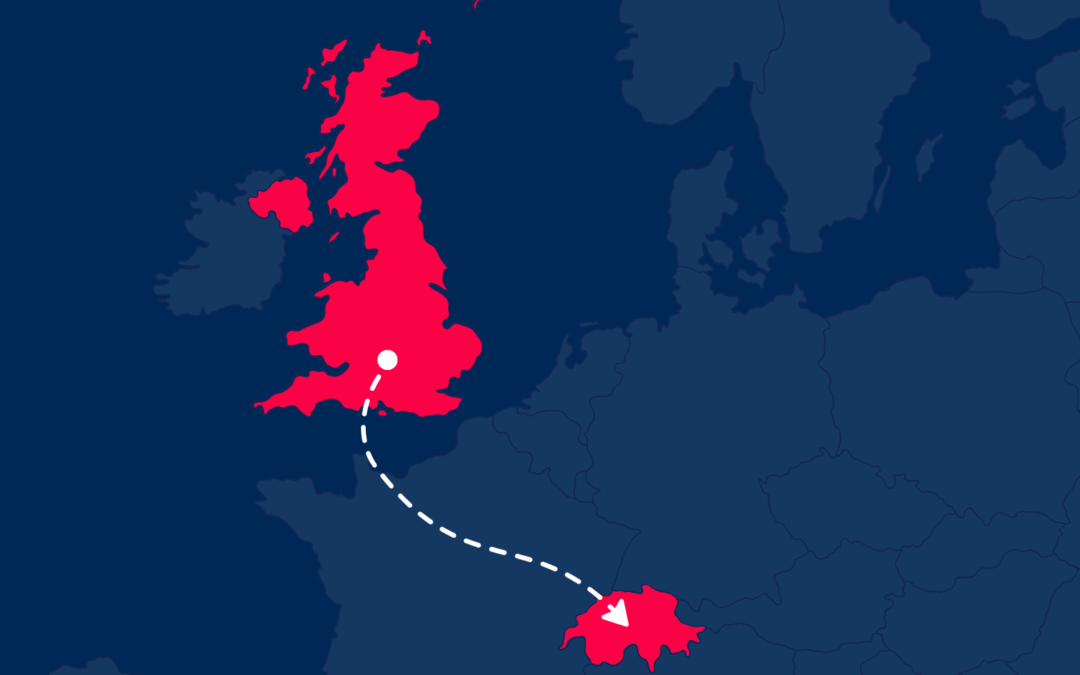

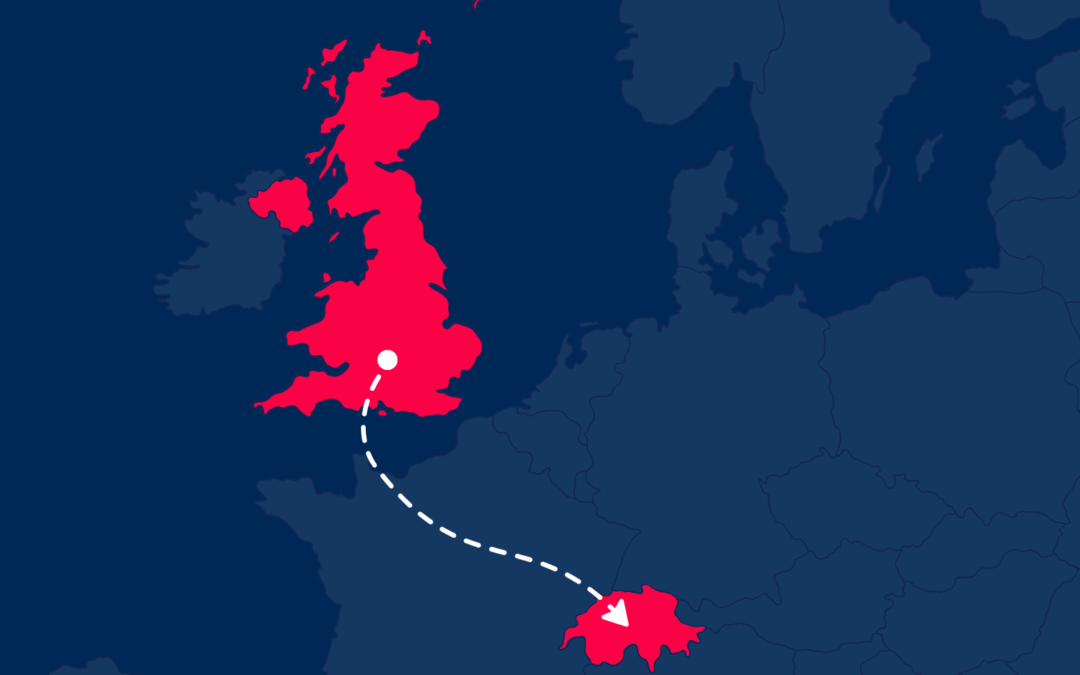

With the end of the «non-dom» regimes in the UK and Portugal, Switzerland remains a favoured alternative thanks to its lump-sum taxation, offering a stable and predictable framework for wealthy taxpayers.

With the end of the «non-dom» regimes in the UK and Portugal, Switzerland remains a favoured alternative thanks to its lump-sum taxation, offering a stable and predictable framework for wealthy taxpayers.

As the UK and Portugal reform their «non-dom» and «non-habitual resident» regimes, Switzerland's lump-sum taxation remains an attractive alternative - offering foreign taxpayers a simplified and expenditure-based tax framework.

Business Intelligence transforms your data into actionable information. Use dashboards, advanced analyses and predictive insights to improve your business strategy.

Une entreprise que nous avons accompagnée dans sa valorisation a rencontré un grand succès et une belle visibilité dans les médias. Avec sa participation à l’émission « Qui veut être mon associé » sur M6.

Anyone in gainful employment is obliged to pay contributions from 1 January following their 17th birthday until they reach AHV retirement age. People born in 2006 will start paying contributions in 2024.

Vous êtes salarié·e, indépendant·e, propriétaire immobilier, entrepreneur-actionnaire ou proche de la retraite ? Vous recherchez un partenaire qui vous accompagne et vous conseille au sujet de votre fiscalité ?

Pour éviter les prélèvements obligatoires (impôt à la source et cotisations sociales) parmi les plus lourds d’Europe, les frontaliers télétravailleurs doivent respecter la limite maximale de télétravail en France et avoir leur attestation A1

The abolition of customs duties on industrial products will come into force in Switzerland on 1 January 2024.

Votation populaire du 18 juin 2023 – Pourquoi un OUI à la LEFI serait-il bénéfique pour l’ensemble des contribuables genevois·es ?

Votation populaire du 18 juin 2023 – Pourquoi un OUI à la LEFI serait-il bénéfique pour l’ensemble des contribuables genevois·es ?

Why would acceptance be dangerous for Geneva's economy and the middle class?

Geneva's Grand Council has voted unanimously to abolish municipal business tax.

In this difficult period of inflation, when everything is going up, there is finally some good news: on 16 December 2022, the Federal Council approved a reduction in fees to protect trademarks.

Popular initiative «Against the virus of inequality... Let's resist! Abolish tax privileges for large shareholders» (IN 179).

On 1 January 2023, the revised law on public limited companies came into force, with the aim of relaxing certain rules.