Market multiples at a glance

I. The transactional environment

The environment for corporate transactions in Switzerland

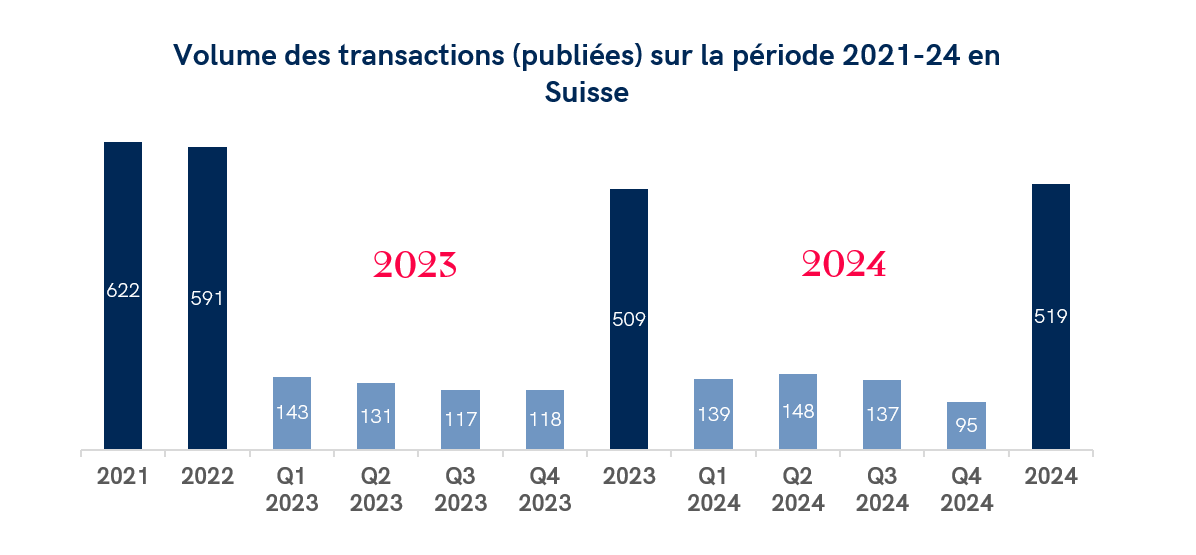

Trading volume (published) in Switzerland :

- Generally speaking, the relatively stable political framework and business climate contribute to a high level of investor confidence. Social regulations are flexible for entrepreneurs, and tax and interest rates are generally competitive with neighbouring countries.

- Switzerland confirms its status as a «key player»In terms of technological innovation, a sector that has played a crucial role in the Group's business activities, the Group has played a key role. M&A in recent years and continues to show promising prospects for the future. In particular, the country is cultivating its lead in high value-added businesses. The success of Swiss companies is due in particular to their highly qualified human capital.

- In 2024, 519 corporate transactions were announced in Switzerland, a slight increase on 2023, when 509 transactions were reported. However, this volume of announced transactions is down on 2022 (591 published transactions), which was a record year due in particular to a rebound effect following Covid-19.

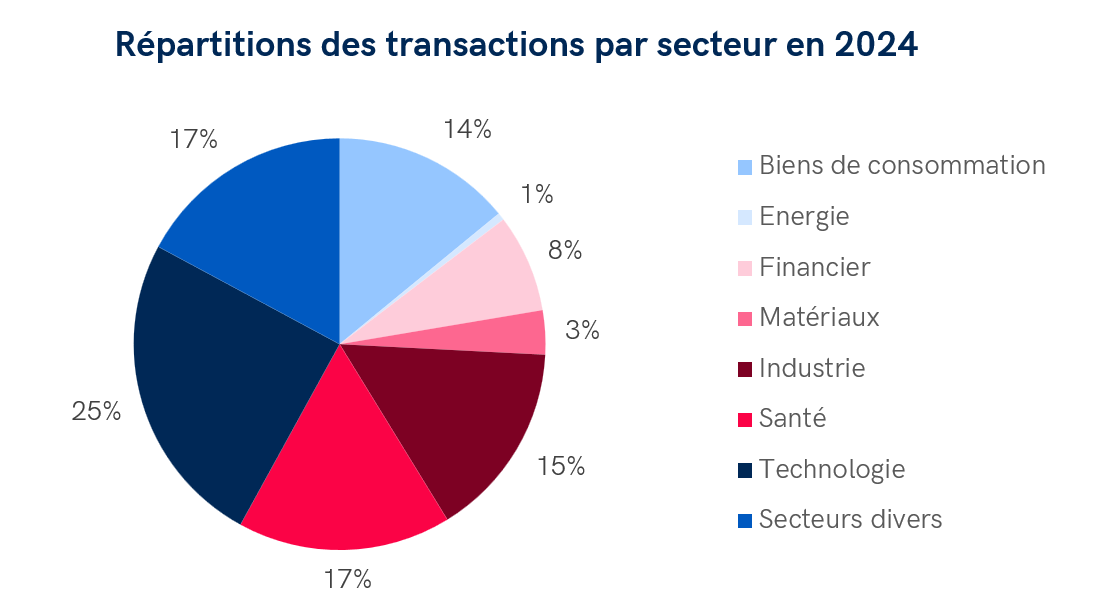

- The M&A market in 2024 is likely to be dominated by the technology sector, with 138 deals reported. It is followed by the healthcare and industrial sectors, with 94 and 89 deals respectively announced by 31 December 2024.

Source : Refinitiv

II. Sector summary at a glance«

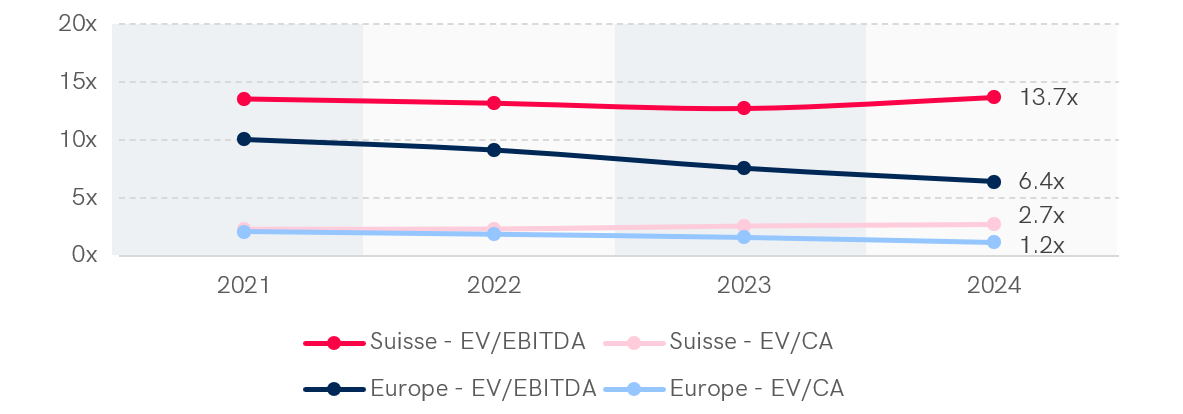

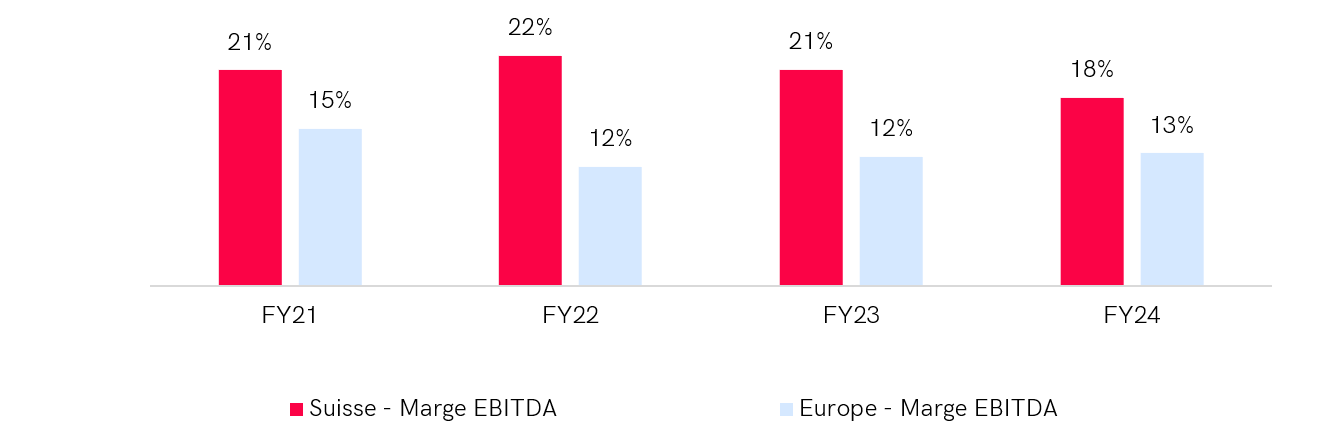

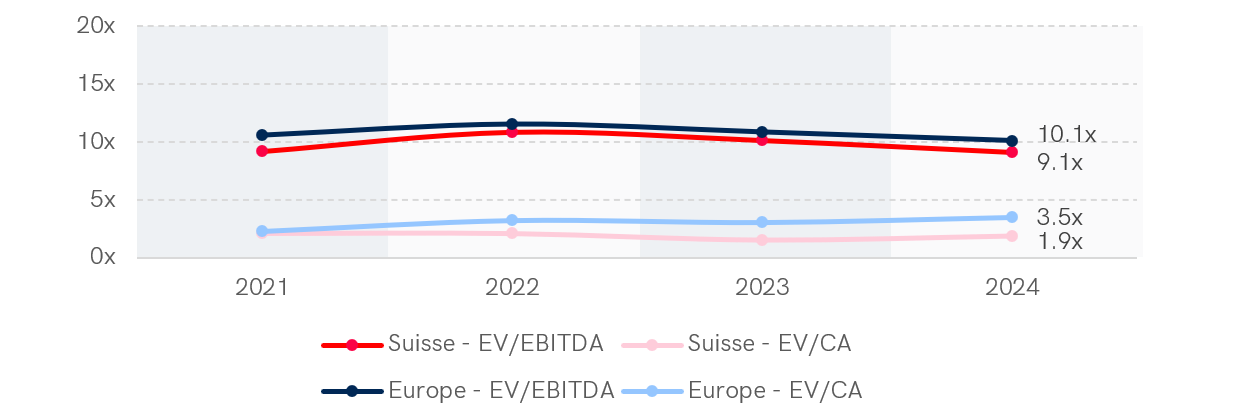

The multiples presented below are based on the following criteria: public companies; geographical sector (Switzerland and Western Europe). Unrepresentative stocks have generally been excluded from these analyses. (Source : Refinitiv).

EV (Enterprise value): enterprise value excluding free cash flow and/or debt

Energy sector

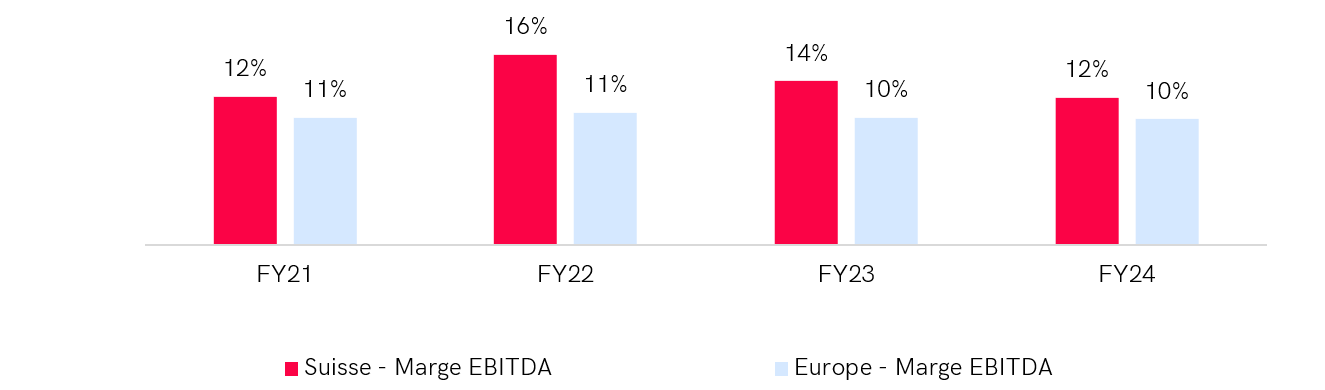

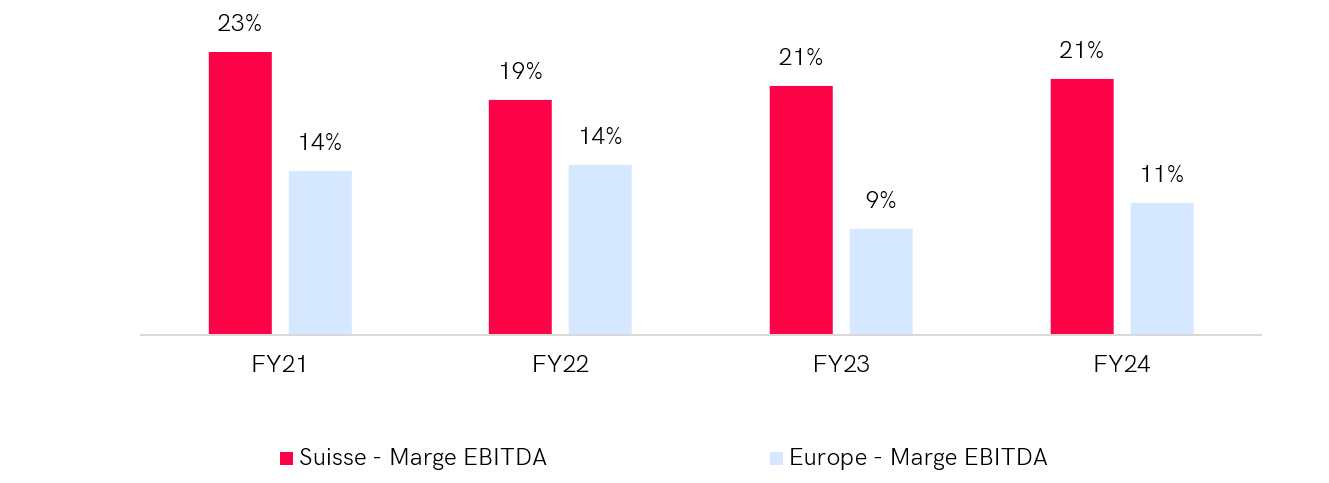

Median multiples in Switzerland and Western Europe over 4 years

Energy

Economic profitability in Switzerland and Western Europe over 4 years

Materials sector

Median multiples in Switzerland and Western Europe over 4 years

Materials

Economic profitability in Switzerland and Western Europe over 4 years

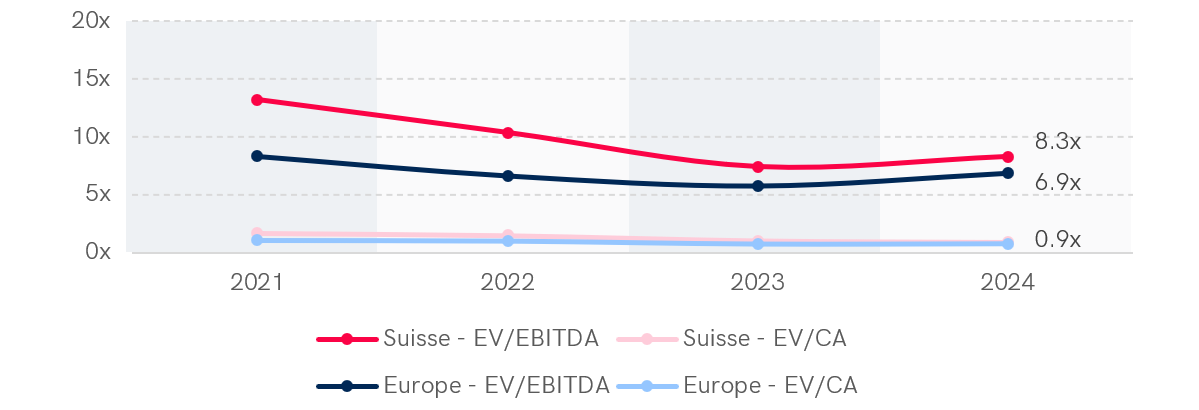

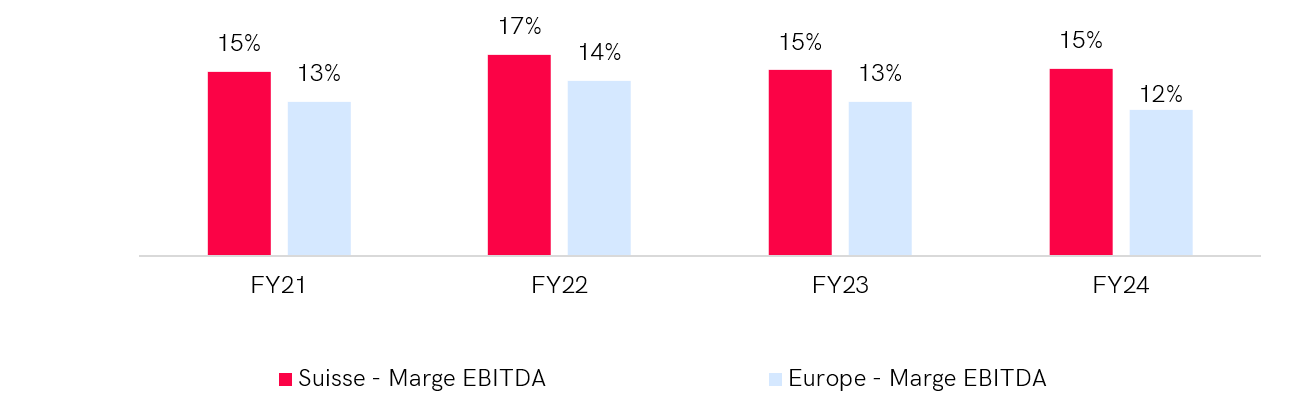

Industry sector

Median multiples in Switzerland and Western Europe over 4 years

Industry

Economic profitability in Switzerland and Western Europe over 4 years

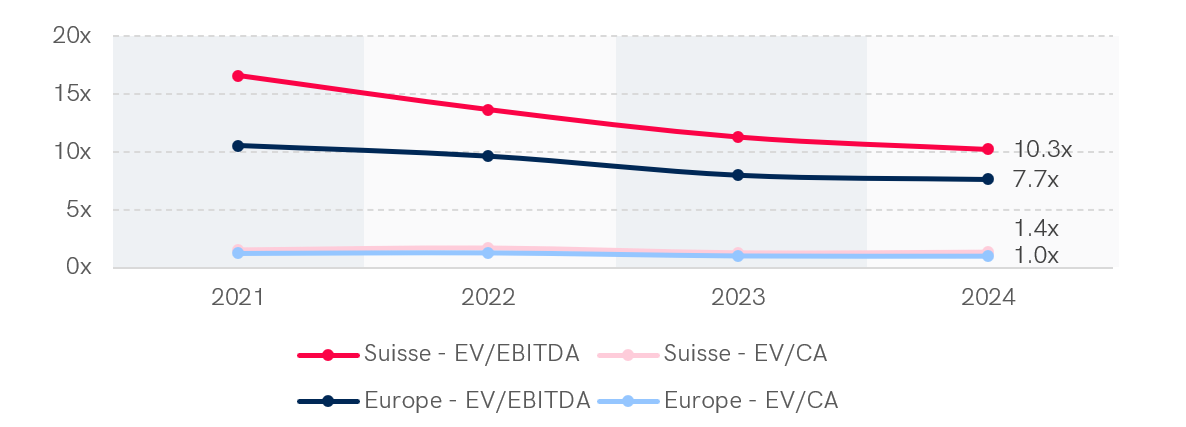

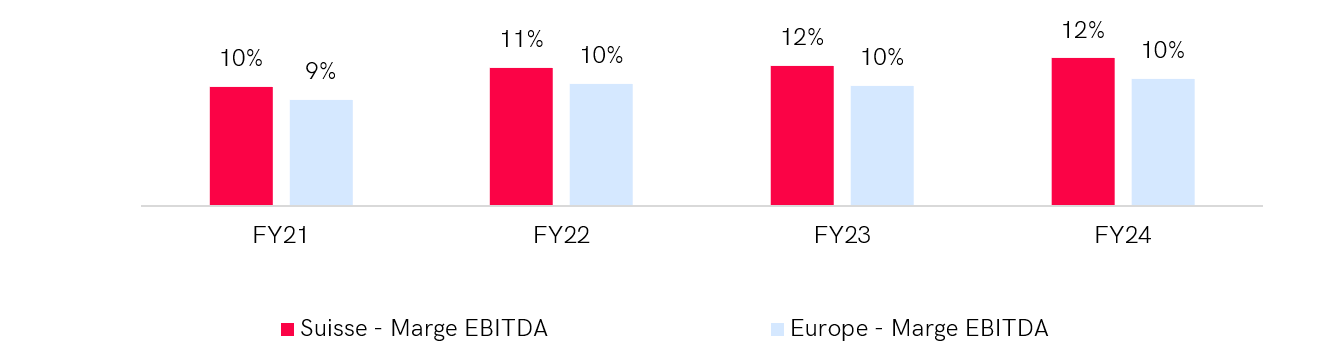

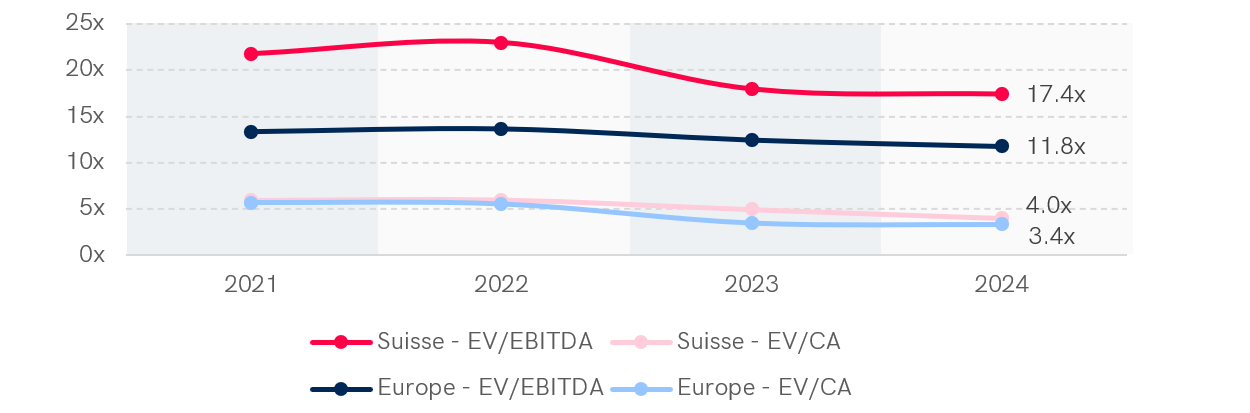

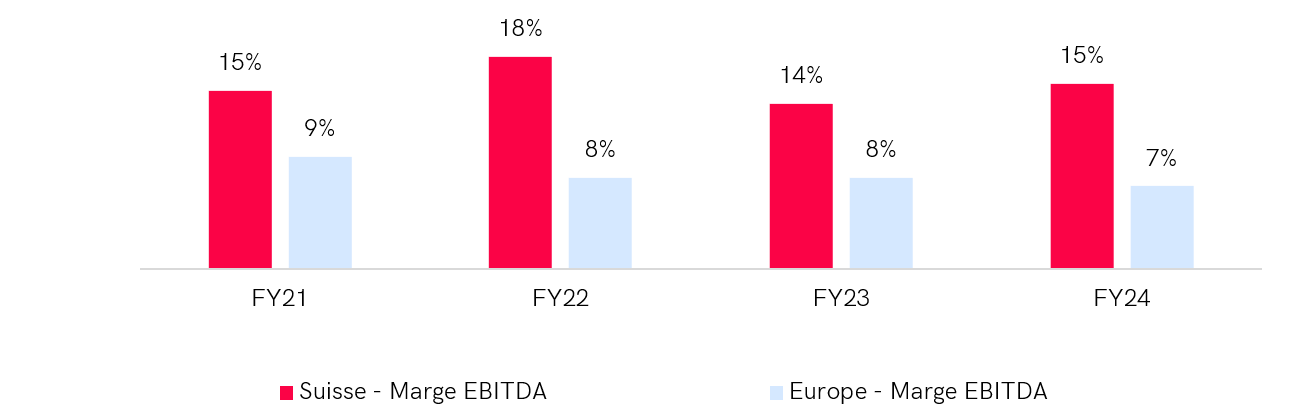

Health sector

Median multiples in Switzerland and Western Europe over 4 years

Health

Economic profitability in Switzerland and Western Europe over 4 years

Recurring consumer goods sector

Median multiples in Switzerland and Western Europe over 4 years

Recurring consumer goods

Economic profitability in Switzerland and Western Europe over 4 years

Occasional consumer goods sector

Median multiples in Switzerland and Western Europe over 4 years

Occasional consumer goods

Economic profitability in Switzerland and Western Europe over 4 years

Financial sector

Median multiples in Switzerland and Western Europe over 4 years

Finance

Economic profitability in Switzerland and Western Europe over 4 years

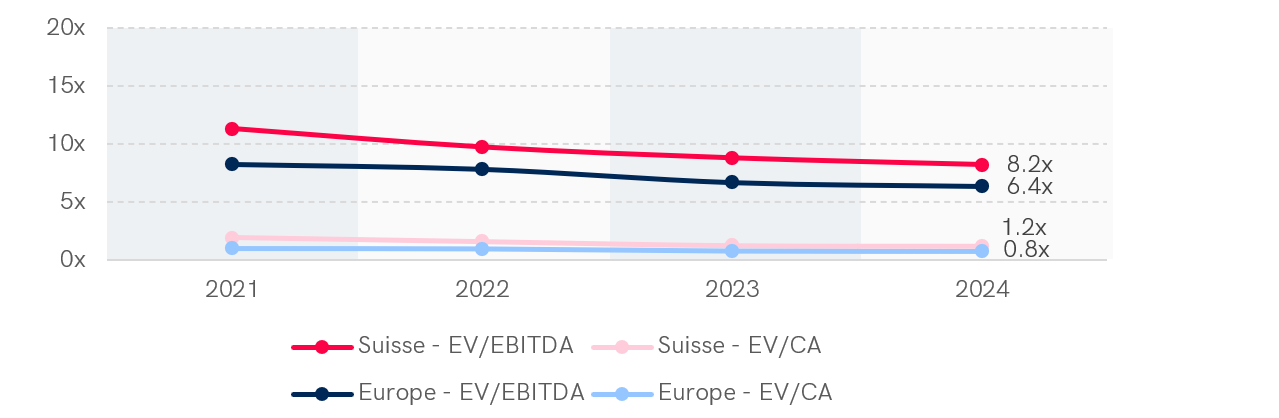

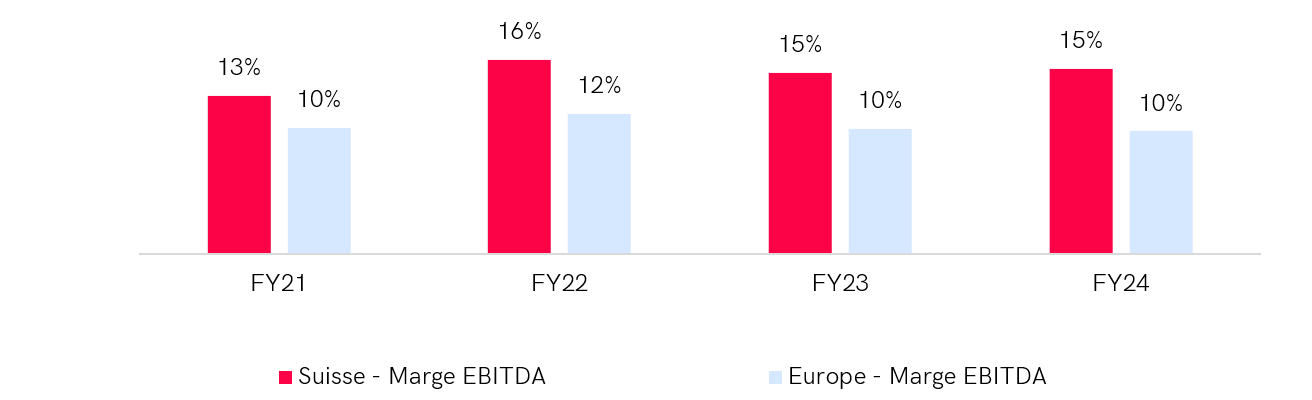

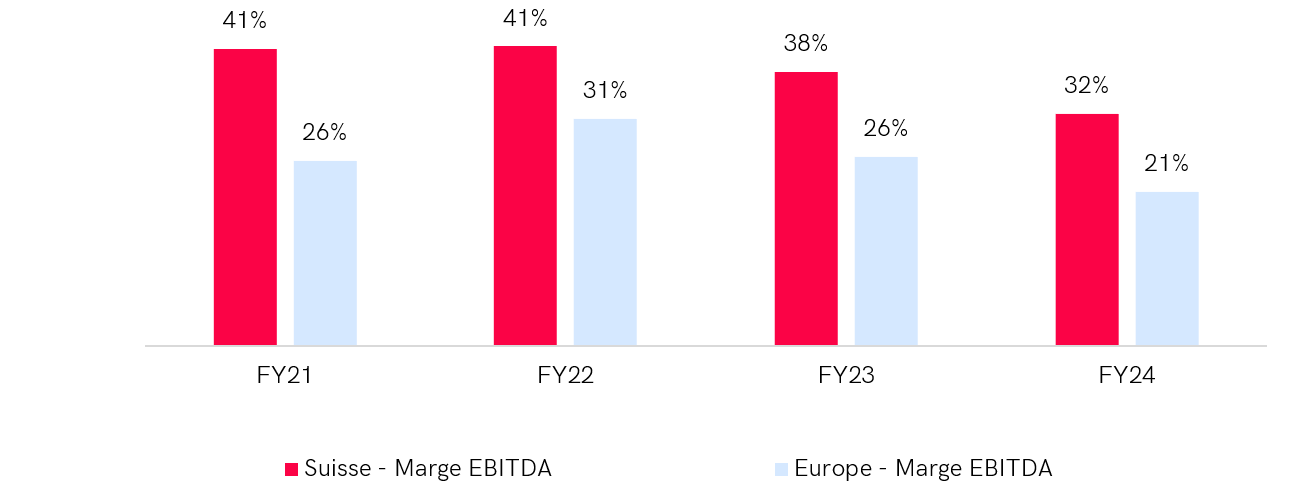

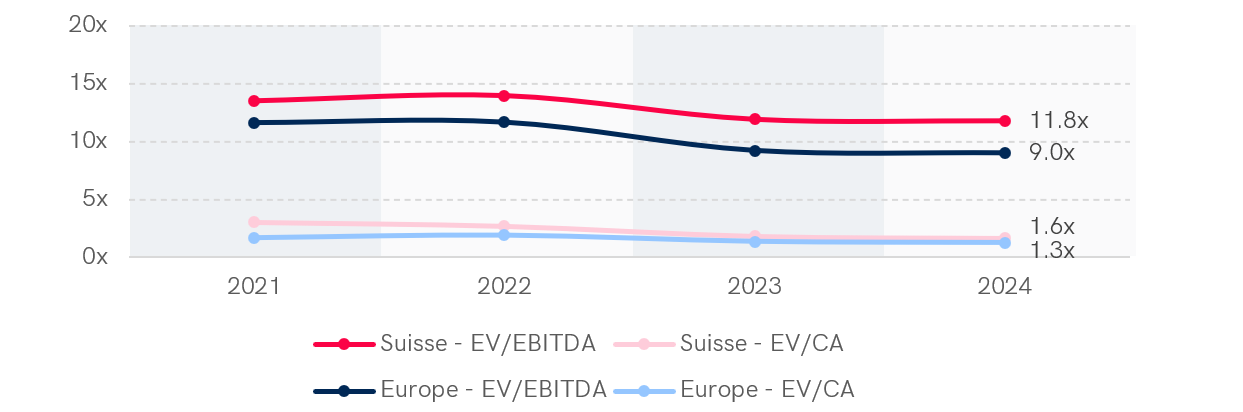

Technology sector

Median multiples in Switzerland and Western Europe over 4 years

Technologies

Economic profitability in Switzerland and Western Europe over 4 years

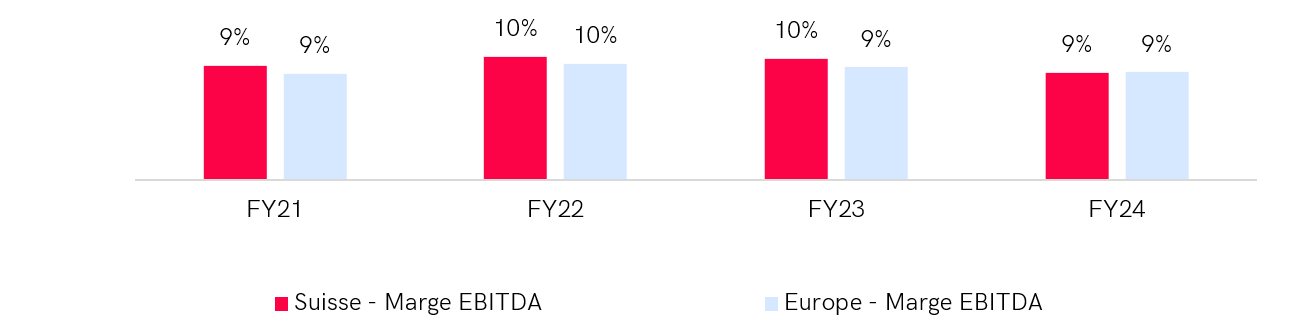

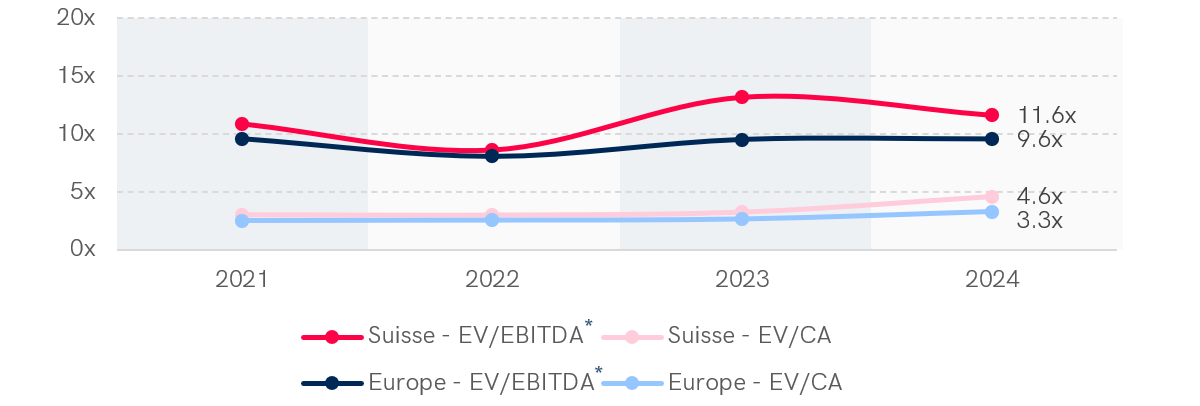

Service sector

Median multiples in Switzerland and Western Europe over 4 years

Services

Economic profitability in Switzerland and Western Europe over 4 years

III. Outlook

Confirmed recovery in transaction activity

1. Gradual recovery

-

-

-

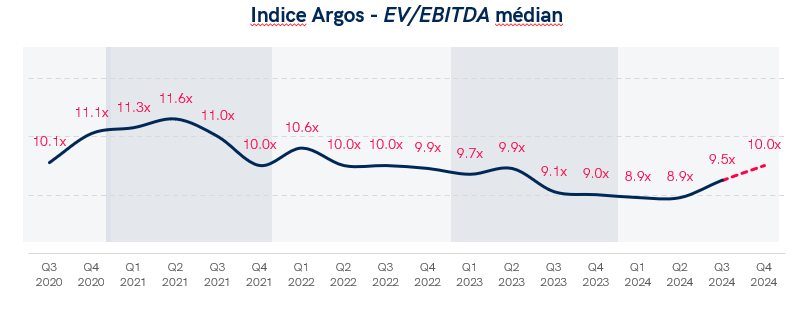

- According to Argos Index®, EV/EBITDA multiples reached 9.5x in Q3 2024 after three years of decline, However, EV/EBITDA multiples for SMEs in Switzerland are significantly lower (6.5x on average).

-

-

-

-

-

- L’Argos Index® is a quarterly index that measures the valuation of unlisted mid-market(1) SMEs in the eurozone, based on transaction multiples. Launched in 2006 by Argos Wityu and Epsilon Research, it presents the median of the historical EV/EBITDA multiple over six «rolling» months.

-

-

-

- Valuation differentials are gradually narrowing, with multiples becoming less polarised and extremes becoming rarer, reflecting an apparent stabilisation in the market.

-

-

-

- The gap between the multiples paid by private equity funds and strategic buyers is now 1.3x EBITDA, confirming a post-Covid structural change. Between 2004 and 2020, strategic buyers were occasionally paying higher multiples than private equity funds (0.2x more). Since 2021, these funds have been paying 0.9x more on average, thanks to the availability of capital and the low cost of debt.

-

-

2. New opportunities

-

-

-

- Private equity funds focus on quality assets, willing to pay premiums despite a relatively uncertain macroeconomic environment.

-

-

-

- Opportunities seem to be developing in sectors such as energy, infrastructure and insurance.

-

-

-

-

-

- Investors are adopting diversified strategies, including private club deals and tailored bank debt (acquisition debt).

-

-

Source: Argos Wityu (20.11.2024). Argos Index® 3rd Quarter 2024.

Sources :

- Mid-market: refers to medium-sized companies, with an enterprise value generally between MEUR 15 and MEUR 500.

Latest news

35 ans d’histoire : un anniversaire célébré au cœur de la Laponie

Pour célébrer nos 35 ans, nous avons

emmené 140 collaborateurs en Laponie pour un séjour hors du temps, riche en expériences humaines et en souvenirs inoubliables.

TVA Suisse : échéance du 28 février 2026 à ne pas manquer

Plusieurs changements TVA doivent être annoncés à l’AFC dans un délai de 60 jours après le début de l’année fiscale. Passé ce délai, leurs effets sont reportés à l’année suivante.

Véronique Pipoz devient COO du Groupe

La nomination de Véronique Pipoz au poste de Chief Operating Officer (COO) marque une nouvelle étape dans le développement du Groupe.