The benefits of the lump-sum taxation regime in Switzerland

As of April this year, the United Kingdom will be introducing significant changes to the “non-dom resident” regime, making it less attractive. Similarly, Portugal will implement comparable changes to its “non-habitual resident” regime from the end of April 2025.

In light of these evolving international tax frameworks, it is an opportune moment to consider the Swiss equivalent: the lump-sum taxation (also referred to as “expenditure-based taxation” or “forfait regime”). This system allows foreign taxpayers to be taxed on a simplified and fixed basis, calculated according to their living expenses rather than their worldwide income and wealth.

Our team of specialists has built extensive experience over the years in negotiating such lump-sum agreements. You can rely on our expertise to help you navigate this complex tax environment.

Eligibility conditions

To qualify for lump-sum taxation, the taxpayer (or both spouses if married) must meet all of the following conditions:

1. Not hold Swiss nationality;

2. Be subject to unlimited tax liability in Switzerland for the first time, or after an absence of at least ten years;

3. Not engage in any gainful activity in or from Switzerland.

This tax regime must be requested by the taxpayer, either before his/her arrival in Switzerland or at the latest, prior to his/her first taxation.

Calculation of the tax basis

The lump-sum amount is agreed upon with the relevant cantonal tax authority and is set as the highest of the following three figures:

1. Seven times the deemed rental value of the property acquired by the taxpayer in Switzerland (as assessed by the competent authorities), or seven times the annual rent if the taxpayer is renting a property;

2. The taxpayer’s total annual worldwide living expenses (including taxes);

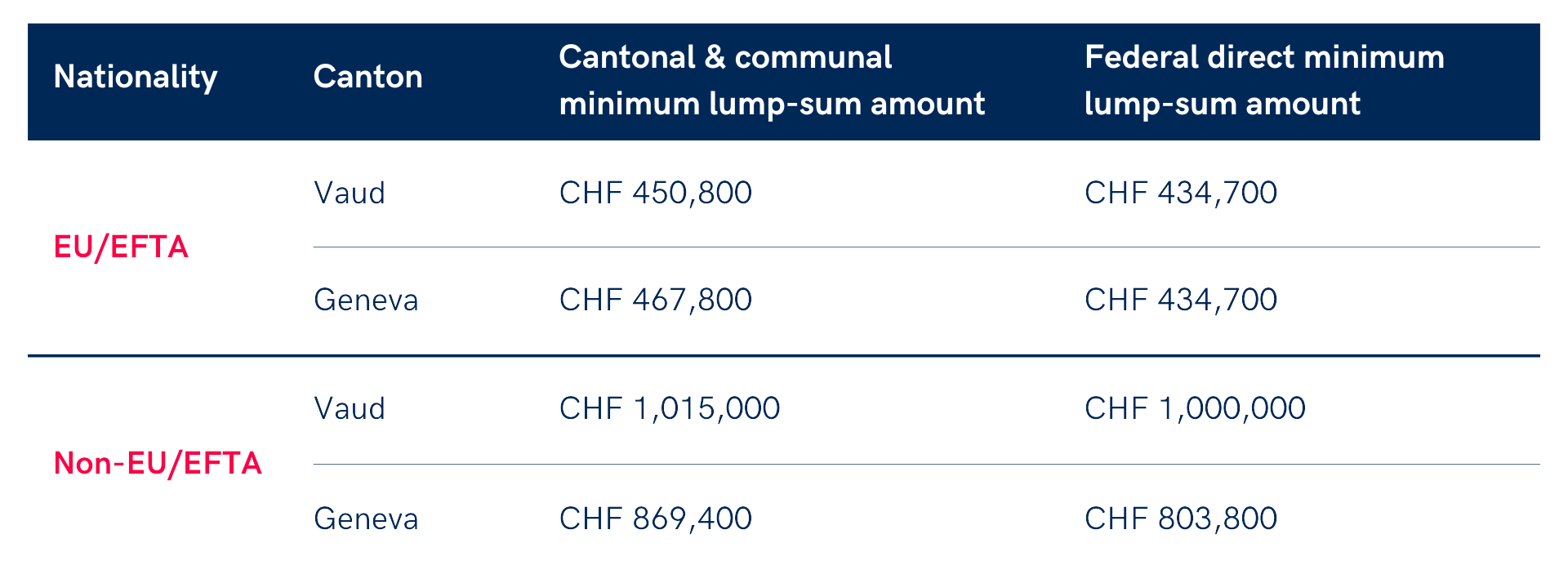

3. The minimum tax base set forth by the law (as indicated in the following chart):

In addition, when completing the tax return, the tax due on the basis of the lump-sum shall be compared with the tax theoretically due on the taxpayer’s Swiss income and assets (so-called “control calculation”). If the amount of tax resulting from the control calculation is higher than the amount of tax due on the lump-sum, the control calculation takes precedence.

Interaction with double taxation agreements

In principle, taxpayers under the lump-sum regime may benefit from Switzerland’s double taxation treaties. However, certain treaties (notably with Germany, Austria, Belgium, Italy, Norway, the United States, and Canada) only apply if income from these countries is subject to taxation in Switzerland.

Comparison between lump-sum taxation and ordinary taxation (Example)

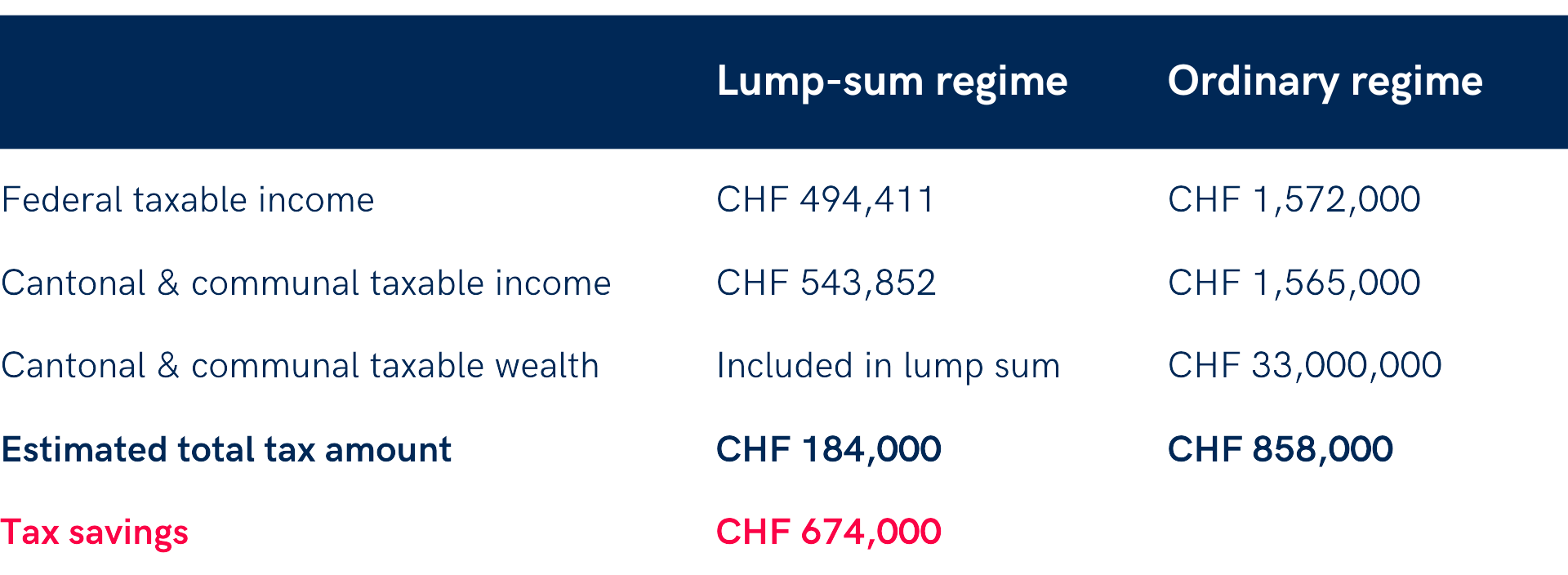

Mrs. Wagner, a retired German national, has until now resided in the United Kingdom under the “non-dom” regime. She decides to relocate to the canton of Geneva in 2025. Her assets—exclusively non-Swiss securities—amount to CHF 30 million, generating an annual return of CHF 1,5 million. She purchased a house in Collonge-Bellerive, where she now resides. The property has been valued by the tax authority at CHF 3 million, with a deemed rental value of CHF 80,000 per year. Her annual living expenses (excluding taxes) amount to CHF 350,000 per year. The tax comparison is as follows:

While some countries are significantly tightening their tax regimes, Switzerland continues to offer attractive opportunities through the lump-sum taxation. This regime involves specific procedures and requires close monitoring. Our tax team, with its solid track record in negotiating such arrangements, is available to answer your questions and support you throughout every step of the process.

Dernières actualités

Nouveautés RH pour 2026

L’année 2026 marque plusieurs évolutions majeures en droit du travail, assurances sociales et fiscalité, avec des impacts concrets pour les employeurs et les salariés. Nous faisons le point sur les changements au niveau national ainsi que sur les mesures spécifiques au canton de Genève.

Votation populaire du 30 novembre 2025 : initiative pour l’avenir

Le 30 novembre 2025, les électeurs suisses seront appelés à se prononcer sur une initiative visant à instaurer un impôt fédéral de 50 % sur les successions et donations dépassant 50 millions de francs. Pensée pour financer la transition écologique, cette mesure soulève des questions concrètes pour les familles propriétaires de PME, les entrepreneurs et les détenteurs de patrimoine important.

Réforme de l’imposition de la propriété du logement

Réforme de l’imposition immobilière en Suisse : suppression de la valeur locative, nouvelles règles de déduction, impôt sur les résidences secondaires. Découvrez l’analyse de nos experts fiscaux.